Archive for July, 2009

The Integration of Micro and Macroeconomics from a Historical Perspective

| Peter Klein |

That’s the title of a conference next week at the University of São Paulo featuring eminent economists and historians of economic thought such as Robert Gordon, Kevin Hoover, Wade Hands, and Phil Mirowski. According to the conference website the proceedings will be streamed live, so you can participate even if you can’t make it to São Paulo.

Attack of the Public Finance Utility Monsters

| Dick Langlois |

I just saw this amusing abstract from Greg Mankiw. I think it will be far too subtle for most people.

The Optimal Taxation of Height: A Case Study of Utilitarian Income Redistribution

Should the income tax include a credit for short taxpayers and a surcharge for tall ones? The standard Utilitarian framework for tax analysis answers this question in the affirmative. Moreover, a plausible parameterization using data on height and wages implies a substantial height tax: a tall person earning $50,000 should pay $4,500 more in tax than a short person. One interpretation is that personal attributes correlated with wages should be considered more widely for determining taxes. Alternatively, if policies such as a height tax are rejected, then the standard Utilitarian framework must fail to capture intuitive notions of distributive justice.

Extra credit: how would such a tax affect NBA salaries — like that of UConn’s seven-foot-three Hasheem Thabeet, who was taken number two in the recent draft?

Special Issue of HRM on “HRM and Knowledge Processes”

| Nicolai Foss |

With Scott Snell (Darden Graduate School of Business) and my SMG colleague Dana Minbaeva, I have edited this just-published special issue of Human Resource Management on the intersection of knowledge management and HRM. One of this highlights of the special issue is an excellent paper by Teppo Felin, Todd Zenger, and Joshua Tomsik that takes issue with some influential ideas on how “knowledge” prompts the emergence of “communal” forms of organizing.

Organizations, Markets, and Health Care Reform

| Russ Coff |

Amidst the fierce debate about the U.S. health care system is a raving lack of clarity. At the core, is whether organizations and markets fail to produce an optimal solution. Even the most neoclassical of economists these days acknowledge that market externalities exist and that these should be the focus of government intervention. Unfortunately, I don’t feel that the debate has been rigorous or well-informed in defining the market failure or why a government run system would be superior.

Liberal Economist Paul Krugman explains why markets fail summarizing Kenneth Arrow’s arguments (here). Basically, the third-party payee system and the information asymmetries render comparison shopping ineffective (and hence competition fails to yield an optimal solution).

Indeed, there is a good bit of inefficiency in the current U.S. system. A recent NY Times article notes that health care costs the average U.S. household $6,500 more each year than other comparable wealthy nations. Unfortunately, looking at many of the important outcomes, it appears that consumers are not getting much for their money on many dimensions (e.g., chronic disease outcomes). So it should be possible to lower costs and improve outcomes. Of course, this ignores the question of whether costs are higher to subsidize R&D that ultimately spills over into other countries.

Unfortunately, the article continues to point out how the reform efforts seem to ignore this low-hanging fruit. (more…)

Introducing Guest Blogger Russ Coff

| Peter Klein |

We’re delighted to introduce Russell Coff as our newest guest blogger. Russ is Associate Professor of Organization and Management at Emory University’s Goizueta Business School. He has published widely on the knowledge- and resource-based foundations of competitive advantage, with a particular focus on human capital and its role in M&A, compensation policy, and other aspects of organizational design. Russ is past Chair of the Academy of Management’s BPS Division and will be pretty busy leading up to and during the AoM meeting, but he’s promised to carve out some blogging time now and between sessions. We’re really looking forward to his insights. Welcome, Russ!

Plus ça change. . .

| Peter Klein |

Another quip from 1215:

The politician’s need to peer at least a short distance into the future, in the hope of getting the timing of difficult choices right, meant that few rulers could afford to dismiss astrology. Non-astronomical methods were tried too: Henry II’s chancellor, Thomas Becket, consulted a palm-reader before embarking on an expedition against the Welsh in 1157. But the transfer of Arabic science made astrology the most impressively academic of all methods for telling the future in the twelfth-century West and many rulers turned to astrologers much as politicians today turn to economists.

Danzinger and Gillingham go on to discuss some twelfth-century critics of astrology: “Evidently then, as now, different people held varying opinions about the science of forecasting.”

IBM Buys SPSS for $1.2 billion

| Peter Klein |

Wow. “In acquiring SPSS, IBM said it was expanding its focus on business-analytics technology and services to meet a growing client need to cut costs. According to IDC estimates, the world-wide market for business analytics software will grow by 4% to $25 billion this year.” SPSS must be the most valuable product ever created by a political science professor. (I may or may not mean just monetary value.) HT: Cliff.

Patenting Economics (and Other Things)

| Nicolai Foss |

The Google Empire appears to be expanding continually, and it is not easy to keep track of its recent conquests. Actually, I learned only yesterday that Google indexes patents and patent applications from the United States Patent and Trademark Office under www.google.com/patents.

The engine — which comprises 7 million patents — is fun to explore. Surprisingly many patent (applications) relate to economics. Many seem downright cranky, such as the application for a Method for the Determination of Economic Potentials and Temperatures (or perhaps I am just ignorant). Lots of management tools are also patented. For example, here is a patent describing a tool for analyzing “strategic capability networks.”

Ian Stewart claims (here) that two prime numbers have been patented (here is the short one: 7,994,412,097,716,110,548,127,211,733,331,600,522,93757,046,707,3,776, 649,963,673,962,686,200,838,432,950,239,103,981,070,728,369,599,816,314,646, 482,720,706,826,018,360,181,196,843,154,224,748,382,211,019 (now, don’t reproduce this, unless you want to get into trouble ;-)), but I haven’t been able to locate them.

Alliances and Internal Capital Markets

| Peter Klein |

An interesting contribution to the literature on internal capital markets from David Robinson, “Strategic Alliances and the Boundaries of the Firm,” appeared recently in the Review of Financial Studies (now the third-ranked journal in finance behind the JF and JFE):

Strategic alliances are long-term contracts between legally distinct organizations that provide for sharing the costs and benefits of a mutually beneficial activity. In this paper, I develop and test a model that helps explain why firms sometimes prefer alliances over internally organized projects. I introduce managerial effort into a model of internal capital markets and show how strategic alliances help overcome incentive problems that arise when headquarters cannot pre-commit to particular capital allocations. The model generates a number of implications, which I test using a large sample of alliance transactions in conjunction with Compustat data.

The model builds on Williamson’s concept of forbearance, the idea that courts will enforce contracts between distinct legal entities but will not intervene in intra-firm disputes. The idea is that moving project with particular characteristics — Robinson calls them “longshots” — from a subunit of a diversified firm to an alliance partner allows the firm’s management to make a credible commitment not to expropriate value from the project manager ex post. Empirical evidence shows that projects with longshot characteristics, measured in various ways using Compustat segment data, are indeed more likely to undertaken by alliance partners. A nice paper with a good mix of theory and evidence.

Is This In the Training Manual for Academic Deans?

| Peter Klein |

Matilda, mother of King Henry II, advising her son on the business of royal patronage (quoted in Danny Danzinger and John Gillinghman, 1215: The Year of Magna Carta, London, Hodder and Stoughton, 2003, p. 178):

He should keep posts vacant for as long as possible, saving the revenues from them for himself, and keeping aspirants to them hanging on him hope. She supported this advice by an unkind parable: an unruly hawk, if meat is often shown it and then snatched away or hid, will become keener, more attentive, and more obedient.

Speaking of deans, I happened to catch Indiana Jones and the Kingdom of the Cyrstal Skull the other day. The film, you probably know, takes place in the 1950s and centers on Indy’s confrontation with a group of Soviet treasure-hunters. Early in the film Indy loses his academic post because of suspected Communist sympathies. At the end, after defeating the bad guys (hope that’s not a spoiler), Indy not only gets his job back, but is made Associate Dean. That this is considered a reward shows how little anyone in Hollywood knows about university life!

Speaking of deans, I happened to catch Indiana Jones and the Kingdom of the Cyrstal Skull the other day. The film, you probably know, takes place in the 1950s and centers on Indy’s confrontation with a group of Soviet treasure-hunters. Early in the film Indy loses his academic post because of suspected Communist sympathies. At the end, after defeating the bad guys (hope that’s not a spoiler), Indy not only gets his job back, but is made Associate Dean. That this is considered a reward shows how little anyone in Hollywood knows about university life!

Thanks to Guest Blogger Benito Arruñada

| Peter Klein |

Thanks to Benito Arruñada for a provocative and insightful series of posts over the last few weeks. We look forward to Benito’s continuing participation in the comment threads here at O&M. You can also follow the action (in English and Spanish) at Benito’s own blog.

Watch for more guest bloggers to be announced soon!

The Zen (or Feng Shui) of Copyright

| Dick Langlois |

Peter blogged some time ago about intellectual property rights in comedy. Turnabout is fair play; and here, in a kind of post-modernist twist, is a comedic take on intellectual property rights — from the Onion.

Intellectual Property Rights as Fleeting as the Scent of Jasmine, Mayfly’s Wing

BEIJING — Settling not on the industrious sons of China, nor on their ware-covered blankets, ownership rights of intellectual property fluttered silently by, unseen, on Monday, as does the gentle mayfly on a warm harvest-time breeze. “Is this a pirated DVD of Transformers 2 dreaming it is an original? Or is it an original Transformers 2 dreaming of an adventurous life as a pirate?” a sidewalk merchant in Tiananmen Square whispered to a moment already gone, as his hands clutched some worldly illusion of the Michael Bay film. “Eight dollars. Plays anywhere in the world.” In their great wisdom, the merchants also carried forth the ancient teachings of Zhuangzi — who spoke of how time is a riddle answered by eternity — to the equally fleeting earthly conceits of trademarked wristwatches, electronics, clothing items, Starbucks, and automobiles.

The piece is part of a new online issue whose conceit is that the Onion has been sold to Chinese interests. It’s quite good — the Onion is at its best when it has an overarching theme, as in the Our Dumb Century book. Of course, one of the multiple layers of meaning in the joke may have to do with the fact that the real magazine actually is apparently up for sale.

More on Wall Street

| Peter Klein |

Further to my recent Wall Street post, see Jeff Tucker’s take, “Capitalism as Drama”:

In the same way that the Godfather movies shaped the culture of organized crime, Wall Street continues to influence the way traders and high-flying capitalists understand themselves.

And it’s no wonder. The impression one is left with is all about the courage, the thrill of the fight, the riskiness of entrepreneurship, that struggle to obtain vast wealth, and the striving for the status of “master of the universe.” It pictures commerce as a gladiator fight, a magnificent and relentless struggle for progress, an epoch and massively important terrain in which the fate of civilization is determined. (more…)

Scandals and Financial Panics in Historical Perspective

| Peter Klein |

The Spring 2009 issue of Business History Review focuses on scandals and panics. Here’s the TOC. Follow the link for abstracts and ordering information.

A SPECIAL ISSUE ON SCANDALS AND PANICS

With an introduction by guest-editor Per H. HansenNaomi R. Lamoreaux: “Scylla or Charybdis? Historical Reflections on Two Basic Problems of Corporate Governance”

Thomas Max Safley: “Business Failure and Civil Scandal in Early Modern Europe”

Richard Sylla, Robert E. Wright, and David J. Cowen: “Alexander Hamilton, Central Banker: Crisis Management during the U.S. Financial Panic of 1792”

Eric Hilt: “Rogue Finance: The Life and Fire Insurance Company and the Panic of 1826”

Edward J. Balleisen: “Private Cops on the Fraud Beat: The Limits of American Business Self-Regulation, 1895-1932”

Federal Reserve “Independence”

| Peter Klein |

I was invited to sign the Open Letter in support of Fed independence but, like Jerry O’Driscoll, Bob Higgs, and Larry White, I don’t support the cause. Follow the links above for detailed arguments. For my part:

1. The Open Letter focuses exclusively on monetary policy, as if the Fed’s Congressional critics like Ron Paul just want to know how the Federal Funds Rate is set. But the Fed conducts not only monetary policy, but fiscal policy as well, especially during the last 18 months. If the Fed can buy and hold any assets it likes, if it works hand-in-hand with the White House and the Treasury to coordinate trillion-dollar bailouts, isn’t it reasonable to have some oversight? (And don’t forget bank supervision. Even the Fed’s defenders recognize a need to separate its monetary-policy and bank-supervision roles. But as long as the Fed continues as a bank regulator, shouldn’t someone should be watching the watchmen?)

2. The Open Letter itself is poorly crafted, full of unsubstantiated assertions and misleading statements. There’s no argument there, as Higgs emphasizes. Actually, neither the time-series or cross-sectional evidence suggests any correlation between central-bank independence (whatever that means) and economic performance.

3. More generally, the Fed is a central planning agency, and it performs about as well as every central planning agency in history. Have we learned nothing from the huge literature on comparative economic systems? “Independence,” in this context, simply means the absence of external constraint. There are no performance incentives and no monitoring or governance. There is no feedback or selection mechanism. There is no outside evaluation (outside the blogosphere). Why on earth would we expect an organization operating in that environment to improve social welfare? Is this institution run by men, or gods?

Rizzo on “Methodological Exclusivism”

| Peter Klein |

Great anecdotes on contemporary social-science methodology in Mario Rizzo’s post, “The Failure of Macroeconomics” (including the comments). Young economist to senior scholar: “All that is in Adam Smith.” Senior scholar: “Maybe — but until my theory it was not science.” Deepak Lal asks distinguished colleague what should be done about the current crisis. Reply: “I do not consider that an intellectually respectable question.” My own beloved dissertation adviser indulged my quirkier interests, but stated plainly: “Methodology is a swamp.” And of course there’s the famous Ed Leamer analogy.

Here’s Mario’s take:

This is the great problem with economics today: methodological exclusivism (or in my more intemperate moments I call it “methodological fascism”).A young person goes to graduate school. He or she is filled with the excitement of ideas. Today, in particular, some may come with a great desire to understand what has happened in the real world of the bailouts, recessions, stimulus, and so forth. And then academic reality hits.

Formal modeling, axiomatic foundations, tractability, technical power, and topological studies. Shall I get an MA in mathematics? Do I need to take a third semester of macro-econometrics? . . .

It seems pretty clear that what we have is a collective insecurity. If we open the floodgates to methodological inquiry, or even worse, to methodological pluralism, we shall become like political science, or God forefend, like sociology. So let’s keep those with disruptive instincts out of the profession. If this is not possible, then let’s at least keep them out of the good schools.

If you’re feeling subversive, you can browse our methodology/theory of science archive for more forbidden thoughts. (more…)

The Organization of Firms Across Countries

| Peter Klein |

Interesting new NBER paper by Nicholas Bloom, Raffaella Sadun, and John Van Reenen, “The Organization of Firms Across Countries” (ungated version here, may be older):

We argue that social capital as proxied by regional trust and the Rule of Law can improve aggregate productivity through facilitating greater firm decentralization. We collect original data on the decentralization of investment, hiring, production and sales decisions from Corporate Head Quarters to local plant managers in almost 4,000 firms in the US, Europe and Asia. We find Anglo-Saxon and Northern European firms are much more decentralized than those from Southern Europe and Asia. Trust and the Rule of Law appear to facilitate delegation by improving co-operation, even when we examine “bilateral trust” between the country of origin and location for affiliates of multinational firms. We show that areas with higher trust and stronger rule of law specialize in industries that rely on decentralization and allow more efficient firms to grow in scale. Furthermore, even for firms of a given size and industry, trust and rule of law are associated with more decentralization which fosters higher returns from information technology (we find IT is complementary with decentralization). Finally, we find that non-hierarchical religions and product market competition are also associated with more decentralization. Together these cultural, legal and economic factors account for four fifths of the cross-country variation in the decentralization of power within firms.

The emphasis on institutional determinants of organizational form makes this a welcome addition to the (slim) set of papers relating institutional arrangements to the institutional environment. (more…)

Social Media Venn Diagram

| Peter Klein |

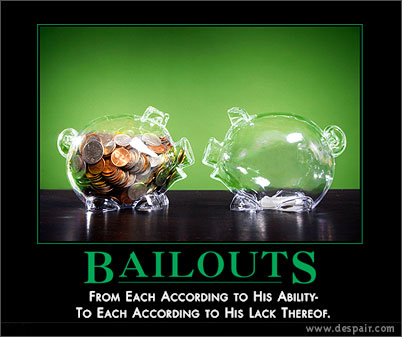

In case you haven’t seen it (via Randy):

From the good folks at Despair, Inc. Don’t miss their new bailout-themed tees here and here. And here’s a good one for Facebook users.

Videos from Entrepreneurship Research Exemplars Conference

| Peter Klein |

Dick blogged previously about the Entrepreneurship Research Exemplars Conference held at UConn in May. The conference organizers have uploaded videos of the keynote speeches by Howard Aldrich, Jay Barney, Mike Hitt, Duane Ireland, Patricia McDougall, and Venkat Venkataraman. You can also watch the editor/author panel sessions in which editors of AMJ, AMR, ET&P, JAP, JBV, JOM, JMS, Org Science, SEJ, and SMJ discuss publication strategies and authors of recently published papers talk about their experiences with writing and revision (Fabio, direct ’em here!). I especially like the SEJ session featuring Yasemin Kor’s discussion of this excellent paper, which I’m told is the most-downloaded paper on the SEJ website. Go figure.

Recent Comments