Archive for February, 2010

Quote of the Day: Bartley on the Marketplace of Ideas

| Peter Klein |

I happened to be looking today through Unfathomed Knowledge, Unmeasured Wealth by W. W. Bartley, III, who passed away shortly after this book was published. Bartley, a student and colleague of Karl Popper and the Founding Editor of The Collected Works of F. A. Hayek, was a brilliant and penetrating thinker whose work is not very well known outside of a few professional circles. Unfathomed Knowledge, a book about higher education (with the subtitle “On Universities and the Wealth of Nations”), was written for a general audience and is full of insights about the crazy business of academia. Here’s one passage:

Analogies have often been drawn between a free market in ideas and free markets in goods and services. Yet intellectuals tend to dislike such comparisons. They see the free market in ideas as something on a higher plane, qualitatively different from free markets in commodities and the like. Many of them indeed even hate the marketplace as traditionally conceived, and would want nothing to do, even analogically, with a free market in coal, housing, fish, or petroleum.

Take a few examples. Several scholars, including Edward Shils, of the University of Chicago, strongly protested the analogy when it was drawn by Michael Polanyi at the Congress for Cultural Freedom. One called Polanyi’s comparison between free markets in goods and in ideas “clever but questionable” in that a man who offers commodities in the free market “is not bound by anything” whereas in science one is bound to an objective method. Shils added that members of the scientific community, by contrast to businessmen and traders, act in accordance with overriding standards, a “common law” above and beyond individuals.

Such a position does not withstand examination. Someone offering commodities in a market — far from being “not bound by anything” — is governed by enforceable law relating to fraud, credit, contract and such like. The analogy does have limits, but of a different sort: in the marketplace of ideas, fraud, plagiarism, theft, false advertising (including false claims to expertise and the whole mystique of expertise), “conspiracies of silence,” casual slander and libel, breach of contract, deceit of all sorts are more common than in business — simply because there are few readily enforceable penalties against offenders, whereas “whistle-blowers” are severely punished. This is so especially in those areas (the humanities, social sciences, the arts — as opposed to the profitable fields) where the transaction costs of enforcing such things as property rights, priority claims, or even accurate report5ing usually outweigh the advantage in doing so, and where the transaction costs of trying to defend oneself against such things as slander are prohibitive.

New Issue of QJAE

| Peter Klein |

The new issue of the Quarterly Journal of Austrian Economics (volume 12, no. 3) has several papers of likely interest to O&Mers. For instance:

Jack High, “Entrepreneurship and Economic Growth: The Theory of Emergent Institutions”

This paper enlarges Menger’s theory of the origins of money by making explicit the role of entrepreneurship in the theory and by extending the theory to market institutions other than money. Drawing on the research of anthropologists, archaeologists, and historians, the paper considers the origins of three institutions that underlie economic growth — the division of labor, monetary accounting, and private property. Menger’s generalized theory of the origins of institutions is used to interpret each of these institutions.

Laurent A.H. Carnis, “The Economic Theory of Bureaucracy: Insights from the Niskanian Model and the Misesian Approach”

Governmental interventions in the economy take numerous forms, and they require the existence of a public authority, a bureaucracy, to implement them. This article proposes an analysis of the origins and the dynamics of bureaucracy, and discusses means of escaping bureaucracy’s disadvantages. I will proceed by means of a comparison between the theories of Niskanen and Mises, two impressive and very representative works from the Public Choice School and the Austrian School of economics. Although Mises and Niskanen share a common analysis of the defect of bureaucratic management, there are strong disagreements between the two authors about the reasons for the existence of bureaus and about their functioning and their deficiencies. Inevitably, the means proposed by Niskanen and Mises for escaping the disadvantages of bureaucracy are different and cannot be reconciled.

Scott Galloway Is My New Hero

| Peter Klein |

For this brilliant performance in his Brand Management class at NYU (via Cliff). Says he to whiny MBA student:

You state that, having not taken my class, it would be impossible to know our policy of not allowing people to walk in an hour late. Most risk analysis offers that in the face of substantial uncertainty, you opt for the more conservative path or hedge your bet (e.g., do not show up an hour late until you know the professor has an explicit policy for tolerating disrespectful behavior, check with the TA before class, etc.). . . .

In addition, your logic effectively means you cannot be held accountable for any code of conduct before taking a class. For the record, we also have no stated policy against bursting into show tunes in the middle of class, urinating on desks or taking that revolutionary hair removal system for a spin. However, xxxx, there is a baseline level of decorum (i.e., manners) that we expect of grown men and women who the admissions department have deemed tomorrow’s business leaders.

And the life lesson:

Getting a good job, working long hours, keeping your skills relevant, navigating the politics of an organization, finding a live/work balance . . . these are all really hard, xxxx. In contrast, respecting institutions, having manners, demonstrating a level of humility . . . these are all (relatively) easy. Get the easy stuff right xxxx. In and of themselves they will not make you successful. However, not possessing them will hold you back and you will not achieve your potential which, by virtue of you being admitted to Stern, you must have in spades. It’s not too late xxxx. . . .

Bravo!

Industry-Level Effects of Government Spending

| Peter Klein |

A consistent theme of this blog’s postings on the financial crisis and recession is that the Keynesians focus on too high a level of aggregation. As economists and management scholars we care primarily about industries, firms, and individuals, not abstract macroeconomic aggregates like GDP, the “price level,” etc. Heterogeneity matters, and the way stimulus programs affect the allocation of resources across firms and industries is as important, or more important, than their economy-wide effects.

A new NBER paper by Christopher Nekarda and Valerie Ramey uses disaggregated industry-level data to examine the effect of the current US stimulus program on output, employment, real wages, and productivity. They find, not surprisingly, that increases in government spending directed toward a specific industry raise that industry’s short-term output and employment but — contrary to New Keynesian predictions — reduce that industry’s real wages and productivity.

Nekarda and Ramey note that stimulus spending has been directed disproportionately to durable-goods manufacturing and that these industries have higher returns to scale than other industries, possibly explaining how reductions in industry-level productivity could look like productivity gains in the aggregate. In other words, stimulus spending reduces efficiency in all industries, but directs resources toward industries that were more efficient to begin with, giving the appearance of a positive aggregate effect. Thoughtful and provocative.

The Best and the Brightest

| Dick Langlois |

I read Peter’s post about paternalism — and the limits of smart people in government — just after I read about the death of Carl Kaysen, long-time MIT economist and one-time Kennedy advisor. Obituaries praise Kaysen for his role as a policy intellectual of great scope, especially in the area of nuclear non-proliferation. But they either fail to mention, or mention with considerable approval, Kaysen’s pivotal role in the famous 1954 United Shoe Machinery case. Kaysen’s view of the case, and of the role of economic analysis in antitrust, is a key example of what Williamson calls the “inhospitality tradition” — that any kind of contract we don’t understand must therefore be anticompetitive. In the eyes of many present-day economists, Kaysen is implicated in having destroyed the American shoe machinery industry and with it the American shoe industry. (The post-mortem is by Masten and Snyder.) Not exactly McNamara in Vietnam, but worth mentioning amid the hagiography of Kaysen, not to mention the reawakened culture of elitist decision-making in Washington.

Comparative Institutional Analysis and the New Paternalism

| Peter Klein |

Comparative institutional analysis — defined as the assessment of feasible organizational or policy alternatives — is at the heart of the new institutional economics. Most economists and management scholars recognize, at least implicitly, that individuals and organizations don’t think, act, and choose with reference to some kind of global optimum, but are always evaluating trade-offs among imperfect alternatives. Yet, when it comes to public policy, even trained economists and strategy scholars easily lapse into Nirvana mode. Recent examples discussed her at O&M include the debate over Fed independence, the role of financial regulators more generally, and the “soft” or “libertarian” paternalism favored by Obama’s man Cass Sunstein, among others.

The new paternalism literature suggests that private actors suffer from biases and cognitive limitations such as lack of willpower or self-control, status quo bias, optimism bias, and susceptibility to framing effects leading them to make decisions that are inconsistent with their own preferences. By making marginal changes to the options available to market participants (“nudges”), the private benefits and costs of various actions, and the informational environment in which choices are made, market participants can be led to make “better” choices without reliance on heavy-handed, top-down regulation. The problem, of course, is that this literature virtually ignores the cognitive and behavioral limitations affecting policymakers. Incentive problems are an obvious example, along with the “slippery-slope” problem: the vulnerability of new paternalist proposals “to slippery slopes that can lead from modest paternalism to more extensive paternalism” (Rizzo and Whitman, 2009, p. 667).

Mario Rizzo and Glen Whitman’s have written an excellent set of papers on the new paternalism, the latest of which focuses on the knowledge problem, and how dispersed, tacit knowledge about preferences and constraints limits policymakers’ ability to plan paternalist policies that actually make people better off. The paper is here, and Mario blogs about it here. Highly recommended!

WikiCFP

| Peter Klein |

This seems like a good idea. Mostly IT stuff but some tagged as economics, knowledge management, etc., and you can also search by keyword.

Call for Papers: 4th Int. Workshop on Org. Design

| Nicolai Foss |

The 1960s and 1970s were the heydays of organizational design theory. Since then it has fallen out of favor in organization theory (see this nice paper), mainly surviving in organizational economics. However, solid and important work has been done on organizational design all along by the likes of Lex Donaldsson and Richard Burton (e.g., here). These two gentlemen have, together with George Huber, Dorte Døjbak Håkonsson, and Charles Snow, organized the “4th International Workshop on Organizational Design,” to take place at Aarhus University’s School of Business, 29-31 May 2010. Here is the Call for Papers.

Unfairly Neglected Papers

| Lasse Lien |

I guess we’ve all read papers thinking: Why isn’t this paper routinely cited and part of the canon of …………. (insert whatever). Here is an example of such a paper — IMHO. Be warned that the abstract isn’t close to doing justice to the paper itself. I would love to see examples of the papers O&M readers think are most unfairly neglected. Of course we all feel that our own papers top this list, but ignoring those, which are they?

Product and Factor Markets in the RBV

| Nicolai Foss |

It is often argued that firm strategy is fundamentally rooted in various imperfections. Strategic management has long been characterized by an intellectual division of labor in which the resource-based view handled (strategic) factor market imperfections and various positioning approaches took care of product market imperfections. This dichotomy is beginning to break down. Two recent papers, one a theory of science-based piece, the other a theory piece, discuss the product/factor market dichotomy and show why it is problematic.

In “Theoretical Isolation and the Resource-based View: Symmetry Requirements and the Separation Between Product and Factor Markets,” Niklas Hallberg and yours truly argue that the RBV treats factor markets as imperfect and product markets as perfect (an approach that we argue is adopted from mainstream economics and its tendency to work with on-off assumptions). We argue that this asymmetry is problematic, as there is a general case to be made for symmetrical assumptions and as it borders on logical inconsistency to assume — within the same model — that one set of markets is perfect and another set is imperfect. The paper isn’t online, but you can email me at njf.smg@cbs.dk for a copy. (Abstract below).

In “Chicken, Stag, or Rabbit? Strategic Factor Markets and the Moderating Role of Downstream Competition,” my CBS (Center for Strategic Management and Globalization) colleague, Dr. Christian Geisler Asmussen, models various deviations from perfect(ly competitive) product markets and shows how these impacts firms’ factor market behaviors and whether they can derive rents from resources purchased on these markets. I believe this is the first systematic study of its kind in the literature (and there are some seriously counter-intuitive findings in it). Very highly recommended! (more…)

ACAC Paper Submission Deadline Extended

Due to all the weather-related foul-ups of the last couple of weeks the organizers of the Atlanta Competitive Advantage Conference have graciously extended the submission deadline through this Friday, 19 February 2010. The conference itself is 18-20 May 2010 in (duh) Atlanta. Click the link above for submission information.

ACAC is an O&M favorite, so make plans to participate!

Williamson Tribute in California Management Review

| Peter Klein |

Six new essays on Oliver Williamson by Haas School colleagues appear in the new issue of the California Management Review. They’re behind a subscription firewall, but just $6 a pop. Check ’em out:

Institutions, Politics, and Non-Market Strategy

de Figueiredo, Jr., Rui J.P.

Holdup: Implications for Investment and Organization

Hermalin, Benjamin E.

Antitrust Economics

Shapiro, Carl

Regulation: A Transaction Cost Perspective

Spiller, Pablo T.

Williamson’s Contribution and Its Relevance to 21st Century Society

Tadelis, Steven

Williamson’s Impact on the Theory and Practice of Management

Teece, David J.

Thanks to Mike Cook for the tip.

Mizzou Seminar on Evolutionary Models in Economics and Organization Theory

| Peter Klein |

Thanks largely to the organizing efforts of my colleague and former O&M guest blogger Randy Westgren, a group here at Missouri is examining evolutionary models in economics and organization theory. The centerpiece is a philosophy of science seminar directed by André Ariew, a leading American scholar in the philosophy of biology, especially Darwin and evolutionary theory.

I’ll let Randy explain:

The course is PHL 9830. Normally it is a traditional philosophy of science seminar aimed at graduate students in the department of philosophy, but we hijacked it to examine a specific theme. The subject focus is evolutionary theory applied to biology, economics, and management. There are three general types of questions we ask, (a) clarification, (b) conceptual, and (c) general philosophy of science. (more…)

Industrial Policy Redux

| Peter Klein |

Keynesian economics is not the only once-discredited doctrine making a comeback following the financial crisis. Despite the well-publicized failures of MITI, Sematech, and similar ventures, people are now calling for a new US industrial policy. Here’s a former Shell executive writing in the WSJ about America’s “foolhardy fondness for ‘free market’ philosophies that tell us it’s OK to export all our jobs,” and complaining that “[w]e’ve never systematically used government incentives to help U.S. industry compete across the board. It’s time we did, like everyone else.” Oy vey. A more serious, but equally troubling, proposal comes from Nobel Laureate Edmund Phelps, calling for a “First National Bank of Innovation.” Writing in HBR, Phelps and Leo Tilman worry that high-risk, long-term investments aren’t getting adequate funding, but don’t explain exactly how government funders would compute NPV on anything other than political grounds (which suggests a new acronym: Net Political Value).

The Capitalist Kibbutz

| Peter Klein|

That’s how the Financial Times headlines this fascinating story about the transformation of many Israeli kibbutzim into partially privatized, profit-seeking, professionally managed entities that act in capital, product, and factor markets just like private firms. There are some similarities with the end of the socialist experiment in Russia: “‘The kibbutz was never isolated from society,’ says Shlomo Getz, the director of the Institute for Research of the Kibbutz at Haifa University. ‘There was a change in values in Israel, and a change in the standard of living. Many kibbutzniks now wanted to have the same things as their friends outside the kibbutz.”

The bottom line, from economist and former kibbutznik Omer Moav: “People respond to incentives. We are happy to work hard for our own quality of life, we like our independence. It is all about human nature — and a socialist system like the kibbutz does not fit human nature.” (Via BK Marcus.)

Measure for Measure

| Craig Pirrong |

The FT has an interesting article about the difficulties and uncertainties facing cap & trade schemes, even in Europe where they’ve been implemented. A good part of the article focuses on the loss of intellectual coherence in climate policy in Europe, as regulations and taxes are being mooted to reduce CO2 emissions. Such command and control bolt-ons are inconsistent with the basic concept of cap & trade, which is that by determining a price of carbon the market will induce efficient responses to reduce emissions on all relevant dimensions:

And the more the carbon market shrinks in its ambitions, the more it faces a broader threat: that of losing touch with its original objective. Credits could continue being traded in the old way. But if the main thrust of carbon reduction is tackled by other means, the market could face questions about its social utility.

But to me, the most interesting part of the article relates to the arcane area of offsets: (more…)

Happy Schumpeter Day

| Peter Klein |

Today’s the birthday of Joesph A. Schumpeter, one of the great theorists — and one of the great characters — in the history of economics. To celebrate, how about remembering some of the classic Schumpeter quotes:

“[Competitive] behavior . . . is the result of a piece of past history and . . . as an attempt by those firms to keep on their feet, on ground that is slipping away from under them.”

“The process of Creative Destruction is the essential fact about capitalism … it is not [price] competition which counts but the competition from . . . new technology . . . competition which strikes not at the margins of profits . . . of existing firms but at their foundations and their very lives.”

“Intellectuals are people who wield the power of the spoken and written word, and one of the touches that distinguishes them from other people who do the same is the absence of direct responsibility for practical affairs . . . .The critical attitude [arises] no less from the intellectual’s situation as an onlooker — in most cases, also an outsider — than from the fact that his main chance of asserting himself lies in his actual or potential nuisance value.”

“[C]apitalism, while economically stable, creates a mentality and a style of life incompatible with its own fundamental conditions. [It] will be changed, although not by economic necessity and probably even at some sacrifice of economic welfare, into an order of things which it will be merely a matter of taste and terminology to call Socialism or not.”

Update: Walter Grinder reminds me that it’s also Julian Simon’s birthday. Here’s a nice tribute from Steven Moore.

Forget Knightian Uncertainty

| Peter Klein |

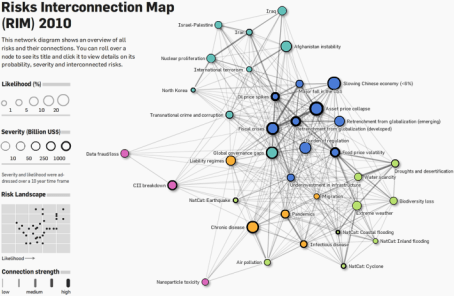

And characterize the world’s uncertain future by listing all possible future events, assigning each a magnitude and probability, linking each event to (causally?) connected events, and sticking them all in a cool interactive graph. I doubt this tells us anything meaningful about the world but it sure is an interesting data visualization exercise! (Datavisualization.ch via Cliff Kuang.)

Missouri Economics Conference

| Peter Klein |

Here’s the CFP for the 10th Annual Missouri Economics Conference, held on the MU campus 26-27 March 2010. The keynote speakers are Michele Boldrin, co-founder of the excellent Against Monopoly blog, and Nobel Laureate Finn Kydland (like me an adjunct professor at NHH — we have so much in common!).

Recent Comments