Posts filed under ‘Business/Economic History’

Upcoming Conferences

| Peter Klein |

- ISNIE, 16-18 June in Palo Alto. Registrations are closed but latecomers could try lobbying the Treasurer to accept a late payment — never mind, that’s me, don’t bother.

- “Open Source, Innovation, and New Organizational Forms,” 1 August in Johannesburg. “This first IPEG conference intends to explore new theoretical and empirical advances in open source organization: the interest is not just on voluntary Open Source Software production and its potential innovation implications, but also on such related ‘open source’ phenomena as collective invention, online collaboration (e.g., Wikipedia), online social networking (e.g., Facebook), open innovation, open science, open source biology, and open standards.” The conference website is not live as of this posting, but organizer Giampaolo Garzarelli can provide details. O&M’s Dick Langlois is a keynote speaker. 500-word abstracts are due 24 June.

- “Achieving Coexistence of Biotech, Conventional & Organic Foods in the Marketplace,” 26-28 October in Vancouver. Speakers include FAO Deputy Director General Ann Tutweiler and Canadian Ag Minister Gerry Ritz. Coexistence conferences have been held every other year since 2003; the first 3 conferences came out of EU Commission efforts, the next was in Australia, and this one is the first to be held in North America. A co-organizer tells me “we hope to bring a more ‘practical’ view of coexistence than is commonly held in Europe.”

Miscellaneous Links

| Peter Klein |

- A public service from our good-twin site: What makes a good review?

- History matters? “[T]he descendants of societies that traditionally practiced plough agriculture, today have lower rates of female participation in the workplace, in politics, and in entrepreneurial activities, as well as a greater prevalence of attitudes favoring gender inequality.”

- Another review of The Invention of Enterprise, by frequent O&M commenter Michael Marotta.

- Regression to the mean? A McKinsey report (via Russ) illustrates the difficulty of long-run supra-normal growth: “a startling 44 percent of all companies that grew at rates faster than 15 percent from 1994 to 1997 were growing at rates lower than 5 percent ten years later.”

- Another attempt to model the evolution of cooperation — this time by Acemoglu and Jackson.

Gulf & Western and the Mob

| Peter Klein |

As a fan of the Godfather films, and a student of conglomerate diversification in the 1960s and 1970s, I’m surprised that I didn’t know, until today, about the connections between Gulf & Western CEO Charles Bluhdorn and the mafia. Paramount, the studio that made Godfather I and II, was at that time a Gulf & Western subsidiary (along with dozens of companies in industries ranging from auto parts to clothing, books, financial services, mining, sugar, cigars — you name it). Gulf and Western was at that time organized as a holding company, or what Williamson calls an “H-form” firm, not a more tightly integrated “M-form,” or multidivisional organization. H-form subsidiaries are operated as highly autonomous units, with little interference from company headquarters, so one wouldn’t expect Bluhdorn to have had much day-to-day contact with Paramount executives.

As a fan of the Godfather films, and a student of conglomerate diversification in the 1960s and 1970s, I’m surprised that I didn’t know, until today, about the connections between Gulf & Western CEO Charles Bluhdorn and the mafia. Paramount, the studio that made Godfather I and II, was at that time a Gulf & Western subsidiary (along with dozens of companies in industries ranging from auto parts to clothing, books, financial services, mining, sugar, cigars — you name it). Gulf and Western was at that time organized as a holding company, or what Williamson calls an “H-form” firm, not a more tightly integrated “M-form,” or multidivisional organization. H-form subsidiaries are operated as highly autonomous units, with little interference from company headquarters, so one wouldn’t expect Bluhdorn to have had much day-to-day contact with Paramount executives.

But apparently he intervened quite a lot. Today’s WSJ featured a piece on Hollywood in the late 1960s and early 1970s, what some regard as a Golden Age of American cinema (besides Godfather, think Chinatown, Nashville, The Conversation, Rosemary’s Baby, etc. — all Paramount films). Evidently Bluhdorn was substantially involved with the production of Godfather, helping make casting decisions and even firing (and re-hiring) producer Al Ruddy. Why such close concern? Paramount executive Peter Bart thought that Bluhdorn had “the mind of a criminal” and was involved with “financiers who had close ties to the mob community.” One of these, I learn from a 2009 Vanity Fair article, was Michele Sindona, a mob-connected banker who died (by poisoning) in an Italian prison. Initially, the Mafia wanted the film scrubbed — unwanted attention and all that — but then relented and helped with production. Several mobsters acted as extras while others helped behind the scenes. A few of the major players, such as Al Lettieri, who played Sollozzo, and Gianni Russo, who played Carlo, were mob connected. Here’s how Russo described getting his part: “Charlie Bluhdorn had a lot of good friends. So I had some people call him and say, ‘You know, this guy Gianni Russo is a very close friend of ours.’”

Inventors During the Industrial Revolution

| Peter Klein |

Following up an earlier post on apprenticeship: Ralf Meisenzahl and Joel Mokyr discuss the role of apprenticeship in the diffusion of innovation among skilled craftsmen during the British Industrial Revolution. “Using a sample of 759 of these mechanics and engineers, we study the incentives and institutions that facilitated the high rate of inventive activity during the Industrial Revolution. First, apprenticeship was the dominant form of skill formation. Formal education played only a minor role. Second, many skilled workmen relied on secrecy and first-mover advantages to reap the benefits of their innovations. Over 40 percent of the sample here never took out a patent. Third, skilled workmen in Britain often published their work and engaged in debates over contemporary technological and social questions. In short, they were affected by the Enlightenment culture.”

Confusing Definitions of Entrepreneurship

| Peter Klein |

Some of you have heard me complain before about the confusing ways “entrepreneur” and its cognates are used in the literature. Sometimes entrepreneurship refers to an outcome or phenomenon (startups, self-employment, high-growth firms), other times to a behavior or attribute (creativity, alertness, innovation, judgment, adaptation). I find the occupational, structural, and functional taxonomy useful, but other organizing schemes may be useful too. In any case, reading the entrepreneurship literature can be a frustrating experience.

I’m glad I’m not the only one who thinks so:

[T]he book’s diversity of approaches and styles is both a strength and also an inherent weakness. Some chapters offer comprehensive descriptions over long periods of time (e.g., Hudson, Hau, Wengenroth, Chan), while others focus on narrow aspects of entrepreneurship (e.g., Yonekura and Shimizu, Mokyr, Wolcott). The first kind appears to be written for a broad audience of noneconomic historians, whereas the second type tends to be drier and more technical. Some authors follow Baumol and distinguish between productive and redistributive entrepreneurship (e.g., Hudson, Mokyr, Cain, Lamoreaux), while others use very broad definitions of entrepreneurship (e.g., Kuran, Casson and Godley, Gelderblom), and yet another group of authors associates entrepreneurship with innovation (e.g., Yonekura and Shimizu, Graham). This extreme diversity of definitions and approaches can overwhelm the reader. As a result, the volume’s ambition of tracing “the history of entrepreneurship throughout the world since antiquity” (p. vii) ends up being an interesting patchwork of insights drawn from different times and places rather than a unifying and synthetic history.

That’s from Michaël Bikard and Scott Stern’s Journal of Economic Literature review of The Invention of Enterprise: Entrepreneurship from Ancient Mesopotamia to Modern Times (ed. David S. Landes, Joel Mokyr, and William J. Baumol, Princeton, 2010), which we blogged about earlier. Obviously in a work of this scope, a common definition of entrepreneurship is likely to be elusive. But the wide variety of meanings in this lone volume give you a sense of the challenge in making sense of the wider literature.

An Early Example of a Hold-up. . .

| Scott Masten |

. . . in which two Irishman sweep fifteen or thirty Italians into an open ditch.

The context is a dispute over a contract for the supply of water to Bayonne, NJ., circa 1896, as reported in The First History of Bayonne, NJ (1904: 92):

At the mayoralty election in the spring of 1895, Egbert Seymour, on the Democratic ticket, was elected Mayor. Several of the Councilmen who were elected at this election, and two or three city officials, were opposed to the new water contract, and attempted a “hold-up.” The trouble reached its height one day during the first year of Seymour’s administration.

While employees of the water company were tapping the old mains to make the necessary water connection, some city officials arrived on the scene. Immediately there was trouble.

The New York Times article (Nov. 24, 1896) on the right (click to enlarge) elaborates, amusingly, on the manner in which the holdup was executed.

I have not yet been able to verify it but, according the previous source, “The matter was taken before the Supreme Court of the United States by the water company, and an injunction was obtained against the city. United States marshals were stationed at the scene until the work was completed, to arrest any city official who interfered.” The city eventually bought out the company in 1918.

(Wish that I had found that quotation before completing this.)

Management Textbooks Bungle Weber

| Peter Klein |

Most management scholars, like most economists, have little interest in doctrinal history, so it’s not surprising they don’t pay much attention to the history of management thought. But Stephen Cummings and Todd Bridgman’s “The Relevant Past: Why the History of Management Should Be Critical for Our Future” (Academy of Management Learning and Education, March 2011) is an eye-opener. Focusing on Max Weber, Cummings and Bridgman document a series of whoppers that appear consistently in leading management texts, such as the belief that “ideal type” means best or optimal; that Weber did his major work in the 1940s (Parsons’s translation of Wirtschaft and Gesellschaft appeared in 1947, 27 years after Weber’s death); that Weber personally admired bureaucracy (In Search of Excellence avers that Weber “pooh-poohed charismatic leadership and doted on bureaucracy”); and other gross misunderstandings. FAIL.

Miscellaneous Links

| Peter Klein |

- Max Weber versus Rodney Stark. Read the very interesting comment thread at this ThinkMarkets post.

- US firms can expect lower worker productivity starting this week. Duh.

- The Austrian School of Economics: A History of Its Ideas, Ambassadors, and Institutions by Eugen Maria Schulak and Herbert Unterköfler. Newly translated from the 2009 German-language original. (Translator Arlene Oost-Zinner was a production editor on my 2010 book and did a wonderful job — no cracks, please, about the need to have my stilted prose translated into passable English.)

- Do you know what really important US patent was granted on March 14?

Interesting New NBER Papers

| Peter Klein |

Matching Firms, Managers, and Incentives

Oriana Bandiera, Andrea Prat, Luigi Guiso, Raffaella Sadun

January 2011

We exploit a unique combination of administrative sources and survey data to study the match between firms and managers. The data includes manager characteristics, such as risk aversion and talent; firm characteristics, such as ownership; detailed measures of managerial practices relative to incentives, dismissals and promotions; and measurable outcomes, for the firm and for the manager. A parsimonious model of matching and incentive provision generates an array of implications that can be tested with our data. Our contribution is twofold. We disentangle the role of risk-aversion and talent in determining how firms select and motivate managers. In particular, risk-averse managers are matched with firms that offer low-powered contracts. We also show that empirical findings linking governance, incentives, and performance that are typically observed in isolation, can instead be interpreted within a simple unified matching framework.

Business Failures by Industry in the United States, 1895 to 1939: A Statistical History

Gary Richardson, Michael Gou

March 2011

Dun’s Review began publishing monthly data on bankruptcies by branch of business during the 1890s. This essay reconstructs that series, links it to its successors, and discusses how it can be used for economic analysis.

The Consequences of Financial Innovation: A Counterfactual Research Agenda

Josh Lerner, Peter Tufano

February 2011

Financial innovation has been both praised as the engine of growth of society and castigated for being the source of the weakness of the economy. In this paper, we review the literature on financial innovation and highlight the similarities and differences between financial innovation and other forms of innovation. We also propose a research agenda to systematically address the social welfare implications of financial innovation. To complement existing empirical and theoretical methods, we propose that scholars examine case studies of systemic (widely adopted) innovations, explicitly considering counterfactual histories had the innovations never been invented or adopted.

Creative Destruction in Popular Culture

| Peter Klein |

Thanks to Thomas B. for forwarding links to US Sen. Rand Paul’s Monday-night appearance on the Daily Show (part 1, part 2, part 3). At the start of part 3, while discussing government bailouts, Paul uses the words “creative destruction,” and Jon Stewart bursts out laughing, apparently hearing the term for the first time. I guess Schumpeter is not as culturally relevant as I thought!

The show had some interesting moments, but I found the discussions (in the parts I watched) pretty shallow. Stewart was grilling Paul on his “free-market” views, focusing on health, safety, and environmental regulation. Both Paul and Stewart took the milquetoast position that sure, some of this type of regulation is needed, but it shouldn’t be “too much.” They didn’t get into a serious discussion of theory or evidence, however, or explore specific trade-offs. There are huge political economy and public-choice literatures on the FDA, EPA, OSHA, etc., showing that these organizations are easily captured, tend to retard innovation, fail to weigh marginal benefits and costs, and so on. The Journal of Law and Economics under Coase’s leadership made its bones on these kinds of studies in the 1970s. The FDA has been a particular target. The Stewart view also ignores comparative institutional analysis — e.g., the role of private ordering (third-party certification, reputation, etc. ) in the protection of health and safety.

At least Paul didn’t say he intended to become the best Senator, horseman, and lover in all Washington!

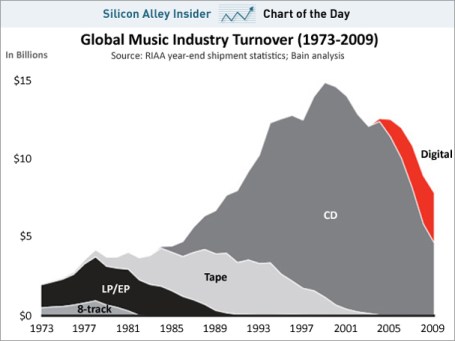

Creative Destruction, Music-Industry Edition

| Peter Klein |

Note that the chart nicely illustrates not only the competition among formats, but the industry’s overall decline. Indeed, “creative destruction” is a good name for the the damage done to the creative arts by the recording industry’s approach to digital media.

New Insight from Old Data

| Peter Klein |

A few years ago Mike Sykuta and I met with Ronald Coase to discuss ways to add contract documents to the CORI library. Limited contract data from secondary sources, like large-company public filings, are readily available, but how to get a larger variety of contract types, such as the long-term supply agreements of particular interest to Coase? Firms are naturally reluctant to make these available to researchers. Coase’s suggestion was to pursue obsolete contracts from company archives. Old contracts, after all, should be as good as current ones for examining hypotheses about contract design and performance, and firms presumably don’t care if they’re made public.

A few years ago Mike Sykuta and I met with Ronald Coase to discuss ways to add contract documents to the CORI library. Limited contract data from secondary sources, like large-company public filings, are readily available, but how to get a larger variety of contract types, such as the long-term supply agreements of particular interest to Coase? Firms are naturally reluctant to make these available to researchers. Coase’s suggestion was to pursue obsolete contracts from company archives. Old contracts, after all, should be as good as current ones for examining hypotheses about contract design and performance, and firms presumably don’t care if they’re made public.

A recent HBR article implores companies to make use of archived datasets, and the advice applies to academic researchers as well. “For example, a retailer that has kept and labeled its old POS data could now subject it to today’s sophisticated analytical techniques, gaining a valuable understanding of long-term consumer trends.” Likewise, revisiting old data with new and better econometrics, more careful attention to research design (e.g., identification), and sharper hypotheses could generate some interesting findings.

In strategy and entrepreneurship research, everybody wants to study the same stuff: pharma and biotech patenting, R&D alliances, technology IPOs, etc. On the margin, a clever study of an old industry, old data, an old problem, could create a lot of value.

Famous Quotations Taken Out of Context

| Peter Klein |

Kenneth Olsen, former head of computer-industry pioneer Digital Equipment Corporation, died over the weekend. DEC was probably the most important “minicomputer” firm of the 1970s and 1980s, one that failed to make the transition to the PC era and dropped out of sight. (DEC plays a major role in Tracy Kidder’s 1981 Pulitzer-winning book Soul of a New Machine — a book I read just this last year and which, despite the now-obsolete subject matter, feels surprisingly fresh. DEC was the dominant incumbent and foil to Kidder’s protagonist firm, Data General.)

Kenneth Olsen, former head of computer-industry pioneer Digital Equipment Corporation, died over the weekend. DEC was probably the most important “minicomputer” firm of the 1970s and 1980s, one that failed to make the transition to the PC era and dropped out of sight. (DEC plays a major role in Tracy Kidder’s 1981 Pulitzer-winning book Soul of a New Machine — a book I read just this last year and which, despite the now-obsolete subject matter, feels surprisingly fresh. DEC was the dominant incumbent and foil to Kidder’s protagonist firm, Data General.)

Despite his many accomplishments — a 1986 Fortune article called him “America’s most successful entrepreneur” — Olsen is remembered today mostly for saying, in 1977, “There is no reason for any individual to have a computer in his home.” This is usually taken to show how the leading mainframe and minicomputer firms failed to see the gale of creative destruction on the horizon, or just to illustrate businessperson cluelessness more generally. (Bill Gates’s 1981 remark that “640K ought to be enough for anybody” falls in the same category.)

Olsen consistently maintained that he was quoted out of context, that he wasn’t talking about the ordinary desktop PC, but a sort of master house computer that would run the home, much like HAL in 2001. According to the useful Snopes.com entry on Olsen, “What Olsen was addressing in 1977 was the concept of powerful central computers that controlled every aspect of home life: turning lights on and off, regulating temperature, choosing entertainments, monitoring food supplies and preparing meals, etc. The subject of his remark was not the personal use computer that is now so much a part of the American home, but the environment-regulating behemoth of science fiction.” As Olsen himself put it: “A long time ago when the common knowledge was that PCs would run our lives in every detail, I said that if you stole something from the refrigerator at night you didn’t want to enter this into the computer so that it would mess up the computer plans for coming meals.” I wouldn’t make that sandwich if I were you, Dave.

What are some other examples of famous quotations taken out of context?

WSJ on Conglomerates

| Peter Klein |

Industrial conglomerate ITT announced in January a split into three more focused companies, one concentrated in hotels and gaming, one in education (technical training centers), and a slimmed-down ITT Corporation containing the remaining manufacturing businesses. This is the second major restructuring for ITT, once the poster child of the conglomerate movement of the 1960s and early 1970s.

The Wall Street Journal’s article of 13 January contains a nice graphic on the firm’s history, including a picture of Harold Geneen, the quintessential “management by the numbers” CEO (click to enlarge). It also includes ruminations on the conglomerate form more generally, about which I have a continuing research interest. Yale’s Jeffrey Sonnenfeld says conglomerates represented “an unholy mix of opportunistic investment bankers, misguided consultants and the vanities of CEOs.” A companion article puts it this way: “Conglomerates blossomed five decades ago, when favorable interest rates made it relatively easy to boost revenue and stock prices with serial acquisitions. But they fell out of favor when the stock increases slowed and investors began to question whether promised efficiencies would materialize.”

The Wall Street Journal’s article of 13 January contains a nice graphic on the firm’s history, including a picture of Harold Geneen, the quintessential “management by the numbers” CEO (click to enlarge). It also includes ruminations on the conglomerate form more generally, about which I have a continuing research interest. Yale’s Jeffrey Sonnenfeld says conglomerates represented “an unholy mix of opportunistic investment bankers, misguided consultants and the vanities of CEOs.” A companion article puts it this way: “Conglomerates blossomed five decades ago, when favorable interest rates made it relatively easy to boost revenue and stock prices with serial acquisitions. But they fell out of favor when the stock increases slowed and investors began to question whether promised efficiencies would materialize.”

But this is not quite right. In fact, the research literature finds little evidence that conglomerate growth was fueled mainly by cheap credit and rising stock prices. (more…)

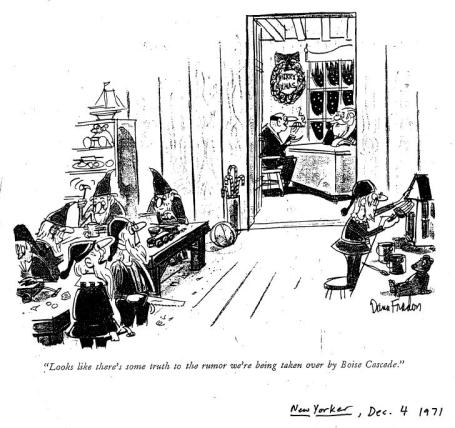

Unrelated Diversification, circa 1971

| Peter Klein |

A funny (to me) New Yorker cartoon about diversification, appearing at the height of the conglomerate merger wave of the late 1960s and early 1970s. Click to enlarge. (I’ve been looking for this for a while; found it when cleaning out an old file cabinet.)

The Internet, circa 1972

| Peter Klein |

Very cool 1972 ARPANET diagram, via Gizmodo, which notes: “It’s pretty amazing to think that this smattering of cables turned into the bizarre, twisted, incredibly complex nebula of porn, parody, knowledge hatred, joy, and cat videos we now adore.”

I imagine the network effects (or, if you like, network externalities) were substantial, despite the small number of nodes. (But these guys were way behind the Victorians.)

For semi-informed musings about the origins of the Internet, and what this implies for organizations and markets, look here.

Love, Marriage, and Money

| Peter Klein |

Most interesting passage I read today:

Contrary to prevailing interpretations that attribute the [historical] rise in voluntary, romantic unions to an increased sexual division of labor and the domestication of family life, Howell argues that true companionship between husband and wife was necessary to weather the challenges of commercial life. In her words, “love was by no means the antithesis of the market. It was the market’s helpmate” (p. 141).

It’s from Francesca Trivellato’s review of Martha C. Howell, Commerce before Capitalism in Europe, 1300-1600 (Cambridge, 2010). As Howell notes, “the commercialization of society was not just an economic history as we understand the term but a social, legal, and cultural story, and it is incomprehensible if told from the perspective of one of these modern conceptual categories alone.”

“Robert S. McNamara and the Evolution of Modern Management”

| Peter Klein |

That’s the title of a new HBR article by Phil Rosenzweig (author of the excellent Halo Effect). I’ve been interested in McNamara and his role in business history since grad school, when I was researching “management by the numbers” and similar techniques that flourished during the conglomerate boom in the 1960s. (See previous O&M posts on McNamara here and here.) Rosenzweig provides a nice summary of some of strengths and weaknesses of McNamara’s dispassionate, “rational,” quantitative approach (see especially the sidebar, “What the Whiz Kids Missed”). Lots of information and ideas related to decision theory, organizational design, multitasking, performance evaluation, innovation, etc. Excerpt:

Whether at Ford or in the military, in business or pursuing humanitarian objectives, McNamara’s guiding logic remained the same: What are the goals? What constraints do we face, whether in manpower or material resources? What’s the most efficient way to allocate resources to achieve our objectives? In filmmaker Errol Morris’s Academy Award–winning documentary The Fog of War, McNamara summarized his approach with two principles: “Maximize efficiency” and “Get the data.”

Yet McNamara’s great strength had a dark side, which was exposed when the American involvement in Vietnam escalated. The single-minded emphasis on rational analysis based on quantifiable data led to grave errors. The problem was, data that were hard to quantify tended to be overlooked, and there was no way to measure intangibles like motivation, hope, resentment, or courage. . . .

Equally serious was a failure to insist that data be impartial. Much of the data about Vietnam were flawed from the start. This was no factory floor of an automobile plant, where inventory was housed under a single roof and could be counted with precision. The Pentagon depended on sources whose information could not be verified and was in fact biased. Many officers in the South Vietnamese army reported what they thought the Americans wanted to hear, and the Americans in turn engaged in wishful thinking, providing analyses that were overly optimistic.

Report on the North Conference

| Peter Klein |

Responsibilities abroad kept me from attending the recent Douglass North celebration, but the University of Missouri was well represented by a group of energetic and enthusiastic PhD students, who sent me the following report:

Responsibilities abroad kept me from attending the recent Douglass North celebration, but the University of Missouri was well represented by a group of energetic and enthusiastic PhD students, who sent me the following report:

The conference on Legacy and Work of Douglass North was an outstanding meeting with discussions on the past, present, and future of the New Institutional Economics. Top scholars discussed the contribution and influence of North (and the New Institutional Economics) in a diverse range of fields, covering everything from the impact of the initial contributions to the outlook for continued research.

It’s hard to summarize the insights and contributions from six paper sessions, Elinor Ostrom’s keynote, and the roundtable on North and the Rise of the New Institutional Economics. One takeaway was the depth and breadth of North’s contributions – many speakers were North coauthors working on a wide variety of topics, from many different perspectives (economics, political science, history, cognition, etc.). North’s influence is huge across the social sciences.

One burning issue: what’s the next step for New Institutional Economics? Besides bridging or integrating Northean institutional analysis with Williamsonian organizational economics, many speakers emphasized the need to be more rigorous, to examine more details, to go farther than the “big picture” studies that are so prominent in the field. There are too many grand, sweeping claims, and not enough mundane, middle-of-the-road analysis. (John Nye, for example, expressed concern that some Northean ideas are very difficult to operationalize, a particular problem since younger scholars are confronted with very high standards for formalization, empirical technique, etc.) (more…)

CRSP 50th Anniversary

| Peter Klein |

Maybe you knew this already, but the Center for Research on Security Prices (CRSP) — the provider of most of the stock-price data used in academic and practitioner research on financial markets — is celebrating its 50th anniversary this year. The center has put up a fancy website, full of interesting factoids, to commemorate the occasion. Did you know, for example, that the first CRSP computer was a UNIVAC, donated by Sperry-Rand though the intervention of Leslie Groves? That the initial data collection effort came in three years late and 200% over budget? (Makes me feel better about some of my own projects.) That CRSP hasn’t used tapes for years, though people still refer to the master file as the “CRSP tapes”? (HT: Gregg Gordon.)

Recent Comments