Posts filed under ‘Corporate Governance’

Self Employment, Entrepreneurship and Economic Growth

| Peter Lewin|

Interesting new monograph from the IEA (Institute of Economic Affairs) in the UK on: Self Employment, Small Firms and Enterprise. A pdf is available for free here. And here is the executive summary.

Summary

- Self-employment is a form of contractual relationship which, in certain circumstances, will have greater benefits to the parties involved than an employer–employee relationship. Government intervention, however, may make selfemployment artificially more attractive by raising the costs of employment relationships.

- Certain ethnic minority groups, older people and those without English as a first language tend to be overrepresented among the self-employed. This is partly because of the flexibility the arrangement provides but also because self-employment offers a ‘safety valve’ for those who find it difficult to find employment in the formal labour market.

- It is vital that businesses are not impeded from moving from a situation where the owner is self-employed without employees to a situation where the business has employees. There is evidence that businesses are impeded in this way. In just nine years to 2009, the proportion of micro-businesses with employees fell by almost one fifth. At the same time the proportion of self-employed with no employees rose rapidly.

- Women, individuals from certain ethnic groups, those with young dependants, those with low or no qualifications, those for whom English is not a first language and those who have recently experienced unemployment make up a much greater proportion of the workforce of small firms. For example, whereas 11 per cent of employees of small firms had no qualifications, only 4 per cent of employees of large firms had no qualifications.

- Some workers will prefer to work for small firms because of the greater flexibility they offer in their working practices. In many cases, however, small firms will employ people who are talented but who are not able to negotiate the more formal recruitment processes of larger firms. Micro-businesses therefore perform an important economic and social function – employing people who might be overlooked by larger employers.

- Genuine entrepreneurial insight and discovery tends to come from small firms. Entrepreneurship is crucial for economic growth. The nature of entrepreneurial insight is such, however, that we have no idea where it will come from – not even in the most general terms. Probably only one in every thousand ‘start-up’ firms will become one of the large businesses of the future.

- Policies to promote entrepreneurship must come in the form of removing impediments to business and should not involve the promotion of particular business activities. It is simply not possible for government intervention to pick this tiny number of winners. All government can do is create a climate in which entrepreneurship can thrive.

- The smallest firms are a key driver of job creation. Businesses do not start big. One quarter of employees working in firms that were established ten years earlier are working for firms that started from a position of employing only one person.

- The cost of regulation has grown enormously over the last fifteen years. This particularly affects small firms with employees because regulatory costs act like a ‘poll tax’. Wide ranging exemptions from employment regulation and the minimum wage would be appropriate for small firms. Such exemptions would have the additional advantage of allowing the government to ‘experiment’ with deregulation. Standard terms and conditions of employment could be drawn up which would ensure that employees clearly understood the exemptions. Radical reforms of the tax system would also assist small firms which experience much greater compliance costs than large firms.

- Moves by the government to promote entrepreneurship through the state education system or provide specific tax exemptions and reliefs for particular forms of business activity are wasteful or counterproductive.

What Do Boards Really Do?

| Peter Klein |

Coase is fond of telling this story about the economist and the horse:

Economics, over the years, has become more and more abstract and divorced from events in the real world. Economists, by and large, do not study the workings of the actual economic system. They theorize about it. As Ely Devons, an English economist, once said at a meeting, “If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’” And they would soon discover that they would maximize their utilities.

Coase, as O&M readers know, prefers direct, hands-on observation to abstract theorizing. As a Misesian [serious, hubba hubba], of course, I can’t endorse this view as a general prescription, though I recognize its value for empirical work. Sometimes it’s best to look at real examples, or to ask real practitioners. Kaplan and Strömberg read through real-world venture-capital contracts to see how control rights were allocated. Genesove and Mullin used the minutes of trade-association meetings, not modeling, to figure out how members of the US sugar cartel maintained compliance.

Here’s another interesting example: “What Do Boards Really Do?” by Miriam Schwartz-Ziv and Michael Weisbach.

We analyze a unique database from a sample of real-world boardrooms – minutes of board meetings and board-committee meetings of eleven business companies for which the Israeli government holds a substantial equity interest. We use these data to evaluate the underlying assumptions and predictions of models of boards of directors. These models generally fall into two categories: “managerial models” assume boards play a direct role in managing the firm, and “supervisory models” assume that boards’ monitor top management but do not make business decisions themselves. Consistent with the supervisory models, our minutes-based data suggest that boards spend most of their time monitoring management: 67% of the issues they discussed were of a supervisory nature, they were presented with only a single option in 99% of the issues discussed, and they disagreed with the CEO only 3.3% of the time. In addition, managerial models describe boards at times as well: Boards requested to receive further information or an update for 8% of the issues discussed, and they took an initiative with respect to 8.1% of them. In 63% of the meetings, boards took at least one of these actions or did not vote in line with the CEO.

I think Ronald would approve.

Academic Nepotism in Italy

| Lasse Lien |

In case you wonder the author of this paper — Stefano Allesina — works in Chicago:

Abstract: Nepotistic practices are detrimental for academia. Here I show how disciplines with a high likelihood of nepotism can be detected using standard statistical techniques based on shared last names among professors. As an example, I analyze the set of all 61,340 Italian academics. I find that nepotism is prominent in Italy, with particular disciplinary sectors being detected as especially problematic. Out of 28 disciplines, 9 – accounting for more than half of Italian professors – display a significant paucity of last names. Moreover, in most disciplines a clear north-south trend emerges, with likelihood of nepotism increasing with latitude. Even accounting for the geographic clustering of last names, I find that for many disciplines the probability of name-sharing is boosted when professors work in the same institution or sub-discipline. Using these techniques policy makers can target cuts and funding in order to promote fair practices.

Allesina, S. (2011). “Measuring Nepotism through Shared Last Names: The Case of Italian Academia.” PLoS ONE 6(8): e21160. doi:10.1371/journal.pone.0021160

Somewhere Over the Rainbow!

| Peter Lewin |

I am envious. My brother in law and my nephew are in the Serengeti National Park in Tanzania. He is sending short reports via his Blackberry. His descriptions are graphic — he is awe-struck. Sounds incredible, beyond imagination — to those of us veteran Africans used to having to search hard for game on our game park safaris. In the Serengeti there is game in exaggerated profusion. Lions, leopards, and cheetah virtually next to each other. Huge migrations of herds, hundreds of thousands strong. A trip for a lifetime. I should live so long.

It seems clear that this wonder of nature (a giant crater-bubble full of wild life) would not exist in the absence of the revenue from international tourism. Though government managed, it is subject to vigorous competition from other game parks in that part of Africa. The area is the traditional homeland of the legendary Masai tribe, who have a cattle-based economy. Population growth, technological change, and the pace of modernity threatened to destroy their world. Now they seem to be flourishing. The Masai have turned out to be successful entrepreneurs! I wonder if this is an instance of Ostrom’s successful local initiatives.

More generally, the preservation of wild-life in Africa has turned on the successful management of a plethora of wild-life game parks (many of them quite small relatively speaking), some having the status of super luxury hotels. There is an irony in there somewhere. (I wonder what it is like to have to manage a wild-life park as a business firm).

Of course most of the environmentalists never tell you about the preservation successes of market competition.

ISNIE Conference Papers

| Peter Klein |

ISNIE held its fifteenth annual meeting last week in lovely Palo Alto, California. President-Elect Barry Weingast put together a terrific program, which you can view here. Many of the papers are also available for public viewing here. A few highlights:

Private Entrepreneurs in Public Services: a Longitudinal Examination of Outsourcing and Statization of Prisons – abstract and paper

Sandro Cabral, (Federal University of Bahia)

Sergio Lazzarini, (Insper)

Paulo Furquim de Azevedo, (FGV-SP)What is Law? a Coordination Account of the Characteristics of Legal Order – abstract and paper

Gillian K. Hadfield, (University of Southern California)

Barry R. Weingast, (Stanford University)Law As Byproduct: Theories of Private Law Production – abstract and paper

Bruce H. Kobayashi, (George Mason Univeristy School of Law)

Larry E. Ribstein, (University of Illinois College of Law)On the Evolution of Collective Enforcement Institutions: Communities and Courts – abstract and paper

Scott E. Masten, (University of Michigan)

Jens Prüfer, (Tilburg University)The ‘Fundamental Transformation’ Reconsidered: Dixit Vs. Williamson – abstract and paper

Antonio Nicita, (University of Siena, and EUI)

Massimiliano Vatiero, (University of Lugano)In the Shadow of Violence: the Problem of Development in Limited Access Societies – abstract and paper

Douglass North, (Washington University (St Louis))

John Wallis, (University of Maryland)

Steven Webb, (World Bank)

Barry Weingast, (Stanford University)

Alberto Diaz-Cayeros, (University of California San Diego)

Gabriella Montinola, (University of Californa Davis)

Jong-Sung You, (University of California San Diego)Entrepreneurial Finance and Performance: a Transaction Cost Economics Approach – abstract and paper

Alicia Robb, (Ewing Marion Kauffman Foundation)

Robert Seamans, (NYU Stern School of Business)Expanding the Concept of Bounded Rationality in TCE: Incorporating Interpretive Uncertainty in Governance Choice – abstract

Libby Weber, (UC Irvine)

Kyle J. Mayer, (University of Southern California)

See the complete list for many more excellent papers.

Bonus (via Lynne Kiesling): the program for a Festschrift conference at Northwestern in honor of Joel Mokyr.

Update: More on the Mokyr conference from Lynne.

Henry Manne on Entrepreneurship

| Peter Klein |

Important new paper by Henry Manne on entrepreneurship (Quarterly Journal of Austrian Economics, Spring 2011). It won’t surprise you to know that Henry has a solution to the problem of encouraging entrepreneurial behavior among corporate managers: allow them to trade on inside information.

Entrepreneurship, Compensation, and the Corporation

Henry G. ManneThis paper revisits the concept of entrepreneurship, which is frequently neglected in mainstream economics, and discusses the importance of defining and isolating this concept in the context of large, publicly held companies. Compensating for entrepreneurial services in such companies, ex ante or ex post, is problematic — almost by definition — despite the availability of devices such as stock and stock options. It is argued that insider trading can serve as a unique compensation device and encourage a culture of innovation.

Missouri Corporate Governance Conference

| Peter Klein |

The University of Missouri’s Trulaske College of Business, Division of Applied Social Sciences, and School of Law are jointly hosting an interdisciplinary conference on corporate governance, 19-21 May 2011 in Columbia, Missouri: “Corporate Governance: The Role of the Board of Directors in Understanding and Managing Disruptive and Transformational Technologies.” Keynote speakers include Renee Adams, Ed Zajac, David Haffner, and Tom Melzer. Check the link above for registration, accommodation, and other information.

AEA Papers on Organizations, Institutions, and Entrepreneurship

| Peter Klein |

O&M readers attending the American Economic Association annual meeting in Denver may find these papers of particular interest:

Industrial Policy, Entrepreneurship, and Growth

PHILIPPE AGHION (Harvard University)Does Management Matter: Evidence from India

NICHOLAS BLOOM (Stanford University)

BENN EIFERT (University of California-Berkeley)

APRAJIT MAHAJAN (Stanford University)

DAVID MCKENZIE (World Bank)

JOHN ROBERTS (Stanford University)Efficiency and Adaptation in Organizations and Institutions

PETER G. KLEIN (University of Missouri-Columbia)

JOSEPH T. MAHONEY (University of Illinois)

ANITA M. MCGAHAN (University of Toronto)

CHRISTOS N. PITELIS (University of Cambridge)The Coevolution of Culture and Institutions in Seventeenth Century England

PETER MURRELL (University of Maryland) (more…)

CRSP 50th Anniversary

| Peter Klein |

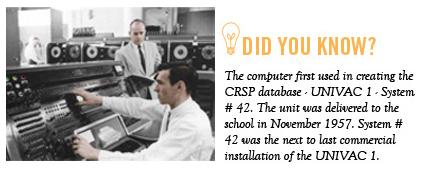

Maybe you knew this already, but the Center for Research on Security Prices (CRSP) — the provider of most of the stock-price data used in academic and practitioner research on financial markets — is celebrating its 50th anniversary this year. The center has put up a fancy website, full of interesting factoids, to commemorate the occasion. Did you know, for example, that the first CRSP computer was a UNIVAC, donated by Sperry-Rand though the intervention of Leslie Groves? That the initial data collection effort came in three years late and 200% over budget? (Makes me feel better about some of my own projects.) That CRSP hasn’t used tapes for years, though people still refer to the master file as the “CRSP tapes”? (HT: Gregg Gordon.)

Assorted Links

| Peter Klein |

- A new paper by Randall Morck and Bernard Yeung, “Agency Problems and the Fate of Capitalism.” A very good comparative-institutional analysis of shareholder democracy and its benefits and costs relative to “stakeholder” models.

- A Washington Post story on “moral licensing” (via Sheen Levine) — suggesting that some people view ethical behavior, like goods and services, in terms of trade-offs at the margin!

- A call for contributions to The Ethics and Economics of Agrifood Competition, a Springer volume in preparation by my colleague Harvey James.

- Videos and papers from the Coase centenary conference held last year at the University of Chicago Law School.

The Ownership of the Firm under a Property Rights Approach

| Dick Langlois |

That’s the title of a new working paper by my Ph.D. student Leshui He. Here’s the abstract:

The boundaries of the firm and the ownership of the firm have been two of the main themes of the economics of organization over the past several decades. In this paper, I develop a general multi-party framework that integrates the ownership of the firm into the property-rights approach to the firm. I consider the ownership of the firm as the ownership of the rights to terminate cooperation with any party while maintaining a contractual or employment relation with all the other related parties of the firm. The model in this paper allows for the separation of the ownership of the firm from the ownership of the alienable assets that partly constitute it. Such a general multi-party setup may provide new tools for the study of the problem of the firm’s boundaries as well as inspiration for further applications of the theory of property rights.

This will be Leshui’s job market paper. Comments (and job offers) welcome.

The Noir Institutional Economics

| Dick Langlois |

The Visible Hand

By Raymond Chandler

It was eight o’clock in the morning, sharp, with the sun not shining and a look of hard wet rain on the Manhattan pavement. I was wearing my heavy gray flannel suit, with rounded collar, display handkerchief, and gold tie with streamlined mechanical shapes on it. As always, I was neat, clean, shaved and sober, and I didn’t care who knew it. I was everything the well-dressed professional manager ought to be. I was calling on the head of General Motors.

From two blocks away I stared at the GM building at 57th and Broadway, its terra cotta façade now etched gray as the pavement, as it wrapped itself around the gothic fantasy of the Broadway Tabernacle at 56th Street. I knew which one was really the cathedral. I didn’t get to inspect the building’s interior for as long as I had the outside. The minute I walked through the front door I was met by a tall, striking female, platinum blonde in finger waves. She wore a cardigan jacket over a skirt and sweater. Her eyes were slate-gray, and had almost no expression when they looked at me.

“Mr. Sloan?”

I admitted as much.

“Follow me, please.”

Following her was easy. She led me into a black-and-gilt elevator. Like all New York elevator men, the operator was small and pinched but looked as though he knew something we didn’t. He brought us up to the top floor, where the cast iron grille of the elevator opened onto an anteroom of the inner-sanctum. When I glanced back, the blonde had already disappeared. I walked in. (more…)

Summary of Dodd-Frank Act

| Peter Klein |

The Dodd-Frank Wall Street Reform and Consumer Protection Act — I’ll refrain from snarks about the title — was signed into law today by President Obama. Here is a very useful summary by William Sweet of the Act’s contents and likely consequences. In a nutshell: “The Dodd-Frank Act effects a profound increase in regulation of the financial services industry. The Act gives U.S. governmental authorities more funding, more information and more power. In broad and significant areas, the Act endows regulators with wholly discretionary authority to write and interpret new rules.” Aren’t you shocked that it passed?

Update: Larry Ribstein is not happy. Weil Gotshal provides further details.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Miscellaneous Organizational Links

| Peter Klein |

- The much-anticipated KKR IPO turned out to be a snoozer. But what the heck is a publicly traded private-equity firm anyway?

- Is the flattening hierarchy an illusion, driven by job-title inflation?

- How call centers use behavioral economics.

- Belén Villalonga’s new paper on ownership concentration and internal-capital-market efficiency — highly recommended.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Stanford Conference on the Asian Firm

| Dick Langlois |

I’m in Palo Alto, having just participated in an extremely interesting conference at Stanford called “The Future of Industry and Innovation in Asia: Firms, Alliances and Networks.” (Papers are not on the website, but you can email the authors.) The conference was organized by Mark Fruin and Raffiq Dossani, and featured people like Martin Kenney, Masao Nakamura, Tim Sturgeon, and Eleanor Westney.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

More on Managerial Coordination and the Vanishing Hand

| Dick Langlois |

Many many thanks to Mari Sako and Susan Helper for taking the time to comment on my post about their paper in ICC. To give the discussion more visibility, I am elevating my response to a new post.

My Vanishing Hand argument is an attempt to explain theoretically the demise of the large multi-unit Chandlerian enterprise, the essence of which was managerial coordination across vertically integrated stages of production. That is to say, my argument was about vertical disintegration. To assert that a more-disintegrated system still uses managerial coordination across firm boundaries is not to resurrect Chandler’s vision; it is to back away from Chandler’s vision. (I document Chandler’s vision, and its intellectual roots, with more care in the book than in the original “Vanishing Hand” paper.) My argument is fundamentally about vertical integration, and I have no problem with the idea that managerial coordination is often exercised across the boundaries of firms. I’ll return to this point in a second.

Sako and Helper argue that, if minimum efficient scale is falling, the size of firms should be falling. And Giovanni Dosi and his coauthors claim that firm size isn’t falling. Well, first of all, MES determines plant size not firm size. It sets a lower bound on firm size; it doesn’t guarantee a smaller firm size. But the real point here is: what does “size” mean? As I pointed out in my response to Dosi et al., their evidence is at best about firm size in the sense of price theory: number of widgets per unit time. My argument is about firm size in the sense of Coase: number of activities undertaken within the boundaries of the firm. Vertical disintegration is perfectly consistent with larger firm size in the sense of price theory; in fact, we might expect it. (more…)

Accounting Conference on Creativity

| Peter Klein |

Hold your accountant jokes, everybody, because the journal Accounting, Organizations, and Society, along with IESE Business School and Sda Bocconi School of Management, is sponsoring a workshop on creativity and it looks really interesting. The workshop, “Debating the Link Between Creativity and Control,” takes place 4–5 April 2011 in Barcelona. Here’s the blurb:

Creativity is more important today than ever before. In fact, in current hypercompetitive environments, where the comparative advantage is easily eroded by technological evolution and by imitative or innovative action of competitors, firms can only react by means of creative processes aimed at renewing market strategies and product lines. Different streams of research on creativity have been developed over time, evolving from different sources, focusing on somewhat different aspects and suggesting a rich set of managerial results.

The aim of the workshop is to start an interdisciplinary debate on creativity, calling together contributors from psychology, sociology, management, and accounting domains. The discussion will explore the link between creativity and control, seen as a promising stream of research not only because of its infancy but most important because of its relevance to the world of management. The event will contribute to unveiling how the dialog between different disciplinary perspectives may lead to a deeper understanding on how to control creativity processes, thanks to the potential synergies deriving from the study of this phenomenon from different theoretical angles.

Further details and submission info below the fold. (more…)

CFP: “Law, Economics, and Finance”

| Peter Klein |

Mike Jensen keynotes this September 2010 conference at York University in Toronto on the links between ethics and finance:

As the world economy struggles out of the financially induced recession, the concept of ethical or socially responsible investment, along with corresponding calls for regulation, will play an increasingly important role in the study of finance for both privately held and publicly traded companies. While there has been a growing literature on law and finance, largely through cross-country studies of publicly traded companies, with somewhat less work on the ethics and finance of publicly traded companies, there has been comparatively little work at the intersection of these topics. As well, there has been comparatively little work on the intersection between law and finance and/or between the ethics and finance of privately held companies. We believe this gap needs to be filled.

The submission deadline is 1 June, so get your manuscripts ready. Full details below the fold: (more…)

Does Behavioral Economics Offer Anything New and True?

| Peter Klein |

One of my frustrations with behavioral economics is that it often seems to restate common, obvious, well-known ideas as if they are really novel insights (e.g., that preferences aren’t stable and predictable over time). More novel propositions are questionable at best (e.g, the paradox of choice).

Dan Ariely’s column in this month’s HBR is particularly frustrating. He claims as a unique insight of behavioral economics that when people are evaluated according to quantitative measures of performance, they tend to focus on the measures, not the underlying behavior being measured. Well, duh. This is pretty much a staple of introductory lectures on agency theory (and features prominently in Steve Kerr’s classic 1975 article). Ariely goes on to suggest that CEOs should be rewarded not on the basis of a single measure of performance, but multiple measures. Double-duh. Holmström (1979) called this the “informativeness principle” and it’s in all the standard textbooks on contract design and compensation structure (e.g., Milgrom and Roberts, Brickley et al., etc.) (Of course, agency theory also recognizes that gathering information is costly, and that additional metrics are valuable, on the margin, only if the benefits exceed the costs, a point unmentioned by Ariely.)

Ariely says firms should not evaluate CEO’s on stock price, but on a variety of measures. What, for example? Here the story gets a bit murky:

Ideally, they’d vary by industry, situation, and mission, but here are a few obvious choices: How many new jobs have been created at your firm? How strong is your pipeline of new patents? How satisfied are your customers? Your employees? What’s the level of trust in your company and brand? How much carbon dioxide do you emit?

Ariely seems unaware that stock price is the most frequently used measure of firm performance precisely because it is a composite measure that captures all of those things. Stock price reflects the best available information about current and expected future performance — products, jobs, customer satisfaction, etc. Is it a perfect measure? Hardly. But it isn’t obvious how owners or Boards can create their own quantitative, composite measure by by picking their favorite elements, proxies, weighting schemes, and so on, in a way that provides better overall assessments of performance than market valuations. Boards, after all, may be predictably irrational too.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Intro to The Capitalist and the Entrepreneur

| Peter Klein |

Here’s a nicely formatted HTML version of the introduction to The Capitalist and the Entrepreneur. I’d apologize for the self-promotion but, well, isn’t that the whole point of blogging?

(PS: Those of you who like to run your transactions through Amazon can get the book here. Not sure about a Kindle edition but I’m told an epub version will be available soon.)

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Recent Comments