Posts filed under ‘Management Theory’

Get Ready for the Slow-Conversation Movement

| Peter Klein |

Conversations today are constantly hijacked by digital fact-checkers. Every fact or statement, it seems, must be checked or augmented in real time with at-our-fingertips online information. We no longer trust each other to come up with good-enough facts or allow each other add colorful embellishment to our stories. Let me give a recent example to make my point. Over lunch the other day, I shared a story with my colleagues — the surreal experience of being accidently given a presidential suite at a Four Seasons Hotel. “This was an amazing room, probably 3000+ square feet with over-the-top appointments everywhere,” I said. No more than two minutes after making the statement, an associate checked on his BlackBerry the size of the presidential suite, correcting me that it was closer to 2000 square feet.

What happened to natural conversations, those based on what is already in our heads, unburdened by verfication? As the fast food movement has seen an opposing slow food movement take hold and shape, I predict we’ll soon see a similar desire for putting down for a moment all the “information enhancements” that come with mobile, digital-sparring tools.

That’s Anthony Tjan blogging at HBR. As someone who reads a lot of student papers — not to mention newspapers, magazines, and blogs — I tend to favor more fact checking, not less. But I see the point.

This is relevant for teaching and public speaking as well. I don’t record my classes, but I suspect that day is not far off (and some of my public talks are already preserved, for better or worse). Will professors be more rigid, overly cautious, less spontaneous, less natural, knowing that everything they say is ripe for verification, by current or future students (or administrators)? What is the appropriate balance between monitoring and governance and classroom spontaneity, ad hocery, and silliness?

O&M in Lund

| Peter Klein |

Nicolai and I, along with Jay Barney and John Matthews, are headlining the 2010 Holger Crafoord Memorial Symposium on “Strategy and Entrepreneurship,” 7 September 2010 at the Lund School of Economics and Management. The symposium is free but registration is required; details at the link above. Lund is a lovely university town, a short train ride (via the Øresund Bridge) from Copenhagen and hence easy to reach. A good time will be had by all.

Nicolai and I, along with Jay Barney and John Matthews, are headlining the 2010 Holger Crafoord Memorial Symposium on “Strategy and Entrepreneurship,” 7 September 2010 at the Lund School of Economics and Management. The symposium is free but registration is required; details at the link above. Lund is a lovely university town, a short train ride (via the Øresund Bridge) from Copenhagen and hence easy to reach. A good time will be had by all.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Lachmann on Capital Heterogeneity

| Peter Klein |

We have written often on the role of capital heterogeneity in an entrepreneurial theory of the firm. “We are living in a world of unexpected change,” wrote Ludwig Lachmann in 1956; “hence capital combinations . . . will be ever changing, will be dissolved and reformed. In this activity, we find the real function of the entrepreneur.” Of course, the concept of heterogeneous resources is fundamental to transaction cost and resource-based views of the firm. It is mostly ignored by mainstream economists, however — macroeconomists in particular, as evidenced by the Old School Keynesianism that drives bailout and stimulus policy.

Here is Richard Ebeling with a fine overview of Lachmann’s capital theory, in contrast to Keynes’s superficial treatment:

A crucial element in Lachmann’s view of capital . . . is that the relationships between and among capital goods are those of substitutes and complements.

The Keynesian fallacy, Lachmann implies, is that Keynes tended to view and consider the capital stock has a more or less homogeneous aggregate under which all capital goods might be considered as interchangeable substitutes. Thus, any increase in capital investment lowers the “marginal efficiency of capital” (Keynes’ term) of every other unit of capital, since every unit of capital is a substitute with all other capital. . . .

Thus, if monetary manipulation brings about an increase in money and credit, and a resulting distortion of the rates of interest, and if this generates a tendency for misguided capital and related investments, and as a consequences capital goods and various types of labor are drawn into particular sectors of the economy and “stages” of the time structure of production, then . . .

You know the rest. And the coda too:

Government interventions and “stimulus” gimmicks merely serve to delay the adjustments and further distort an already distorted market. It is an attempt to maintain capital and labor complementary production and investment structures that are unsustainable in many of the patterns generated during the boom phase of the business cycle.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Academy of Management Conference Open Thread

| Peter Klein |

Much of the O&M extended family is heading home from Montréal, site of the Academy of Management Annual Meeting. I presented one paper, discussed several more, facilitated a research roundtable, and spoke at a doctoral student consortium. Then there are business meetings, editorial board pow-wows, and planning sessions. Plus the really important stuff: socializing, networking, exchanging gossip, and enjoying good food and drink. It was great to see so many O&M bloggers, former guest bloggers, regular and occasional commentators, lurkers, and secret admirers.

Much of the O&M extended family is heading home from Montréal, site of the Academy of Management Annual Meeting. I presented one paper, discussed several more, facilitated a research roundtable, and spoke at a doctoral student consortium. Then there are business meetings, editorial board pow-wows, and planning sessions. Plus the really important stuff: socializing, networking, exchanging gossip, and enjoying good food and drink. It was great to see so many O&M bloggers, former guest bloggers, regular and occasional commentators, lurkers, and secret admirers.

Several sessions dealt with pedagogy, data sharing, research collaboration, and other issues being transformed by the web/wiki/blog/tweet/Facebook revolution. There was even a session on academic blogging featuring some of our friends from That Other Site. Clearly the O&M community is on the cutting edge of organizational research, teaching, and policy.

What did you think of the conference? What were your favorite sessions, papers, discussions, and activities? What could be done to improve future conferences? (Believe it or not, many high-ranking AoM muckety-mucks are regular O&M readers, so now’s your chance to be heard!)

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Does Knowledge Management Improve Performance?

| Peter Klein |

Yes, says Peter Cappelli:

The extensive literature on knowledge management spans several fields, but there are remarkably few studies that address the basic question as to whether knowledge management practices improve organizational performance. I examine that question using a national probability sample of establishments, clear measures of IT-driven knowledge management practices, and an experimental design that offers a unique approach for addressing concerns about endogeneity and omitted variables. The results indicate that the use of company intranets, data warehousing practices, performance support systems, and employee competency databases have significant and meaningful effects on a range of relevant business outcomes.

Cappelli relies on a national (US), establishment-level survey of knowledge-management practices to construct a panel in which (according to the practioner literature) none of the knowledge-management practices under consideration existed at the start of the sample period. Check it out.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Historical Foundations of Entrepreneurship Research

| Peter Klein |

Look for this new collection later this Fall. Hans Landström and Franz Lohrke have put together an excellent set of essays on the intellectual origins and historical development of entrepreneurship research. Nicolai and I have a chapter on “Entrepreneurial Alertness.” Other topics include entrepreneurial orientation, the liability of newness, entrepreneurial groups, governance, social networks, social enterprise, culture, and psychology. Check it out!

Look for this new collection later this Fall. Hans Landström and Franz Lohrke have put together an excellent set of essays on the intellectual origins and historical development of entrepreneurship research. Nicolai and I have a chapter on “Entrepreneurial Alertness.” Other topics include entrepreneurial orientation, the liability of newness, entrepreneurial groups, governance, social networks, social enterprise, culture, and psychology. Check it out!

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Overconfidence

| Peter Klein |

Busenitz and Barney (1997) famously argued that entrepreneurs (founders) are particularly susceptible to overconfidence and representativeness biases. Compared to professional managers, entrepreneurs systematically overestimate the probability that a new venture will succeed and tend to draw unwarranted generalizations about the future from small samples. Overconfidence is now one of the major themes in the contemporary entrepreneurship literature (Bernardo and Welch, 2001; Forbes, 2005; Koellinger, Minniti, and Schade, 2007).

Busenitz and Barney (1997) famously argued that entrepreneurs (founders) are particularly susceptible to overconfidence and representativeness biases. Compared to professional managers, entrepreneurs systematically overestimate the probability that a new venture will succeed and tend to draw unwarranted generalizations about the future from small samples. Overconfidence is now one of the major themes in the contemporary entrepreneurship literature (Bernardo and Welch, 2001; Forbes, 2005; Koellinger, Minniti, and Schade, 2007).

A new NBER paper by Itzhak Ben-David, John Graham, and Campbell Harvey finds evidence for a particular kind of overconfidence, “miscalibration,” among corporate executives. Miscalibration occurs when the agent’s forecast probability distribution is too narrow, meaning that the likelihood of extremely positive or negative events is unrealistically discounted. The idea is that agents with miscalibrated expectations are overconfident, not in the success of their activities (what the authors label “optimism”), but in their ability to predict the success of their activities. Survey evidence from a sample of CFOs reveals a number of interesting regularities about the relationship between miscalibration and past financial performance, corporate investment, and other observables. Here’s the abstract:

Miscalibration is a form of overconfidence examined in both psychology and economics. Although it is often analyzed in lab experiments, there is scant evidence about the effects of miscalibration in practice. We test whether top corporate executives are miscalibrated, and study the determinants of their miscalibration. We study a unique panel of over 11,600 probability distributions provided by top financial executives and spanning nearly a decade of stock market expectations. Our results show that financial executives are severely miscalibrated: realized market returns are within the executives’ 80% confidence intervals only 33% of the time. We show that miscalibration improves following poor market performance periods because forecasters extrapolate past returns when forming their lower forecast bound (“worst case scenario”), while they do not update the upper bound (“best case scenario”) as much. Finally, we link stock market miscalibration to miscalibration about own-firm project forecasts and increased corporate investment.

I’m not aware of any entrepreneurship studies that distinguish miscalibration from optimism, in the sense those terms are used here. Am I missing something?

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati>

Performance Evaluation Links

| Peter Klein |

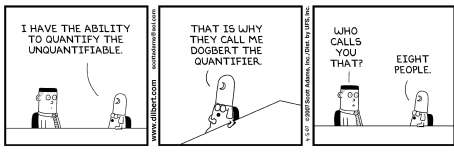

Performance evaluation is a favorite topic here at O&M; readers may enjoy these miscellaneous items on measurement:

- “Is Impact Measurement a Dead End?” by Alanna Shaikh, guest blogging at AidWatch.

- Moneyball’s Michael Lewis on basketball player statistics (HT: PB).

- The Urban Institute’s Outcome Indicators Project for nonprofits.

- Relevant Demotivators: Flattery, Ineptitude, and Mediocrity.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

The Organizational Economics of the BP Oil Spill

Now that passions are cooling regarding the BP disaster, it’s time to bring organizational issues into the discussion.

1. Everyone knows about the liability caps and the role they may have played in encouraging moral hazard. Just as bank deposits are guaranteed by government deposit insurance, and large banks themselves are probably Too Big to Fail, liability for property damage from oil spills off US waters is limited to $75 million (plus cleanup costs), based on a 1990 law passed after the Exxon Valdiz spill. This presumably mitigates drillers’ incentives to manage environmental risk. Indeed, oil companies enjoy a very cozy relationship with their ostensible guardians; as the NY Times noted, “[d]ecades of law and custom have joined government and the oil industry in the pursuit of petroleum and profit.” The federal agency that oversees drilling, the Minerals Management Service, rakes $13 billion a year in fees in what amounts to a public-private partnership. And does anyone really think the British government would “stand idly by” if BP’s status as an ongoing concern were threatened by criminal or civil penalties?

2. As Bill Shughart points out, BP did not own the Deepwater Horizon platform, but leased it from a company called Transocean. To Bill this suggests “a classic principal-agent problem in which the duties and responsibilities of lessor and lessee undoubtedly were not spelled out fully, especially with respect to maintenance and testing of the rig’s blowout preventer as well as to the advisability of installing a second ‘blind sheer ram,’ which may have been able to plug the well after the first (and only one then in service) failed to do so.” Would BP have paid more attention to safety if it owned, rather than leased, the platform? (more…)

Miscellaneous Organizational Links

| Peter Klein |

- The much-anticipated KKR IPO turned out to be a snoozer. But what the heck is a publicly traded private-equity firm anyway?

- Is the flattening hierarchy an illusion, driven by job-title inflation?

- How call centers use behavioral economics.

- Belén Villalonga’s new paper on ownership concentration and internal-capital-market efficiency — highly recommended.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Accounting Conference on Creativity

| Peter Klein |

Hold your accountant jokes, everybody, because the journal Accounting, Organizations, and Society, along with IESE Business School and Sda Bocconi School of Management, is sponsoring a workshop on creativity and it looks really interesting. The workshop, “Debating the Link Between Creativity and Control,” takes place 4–5 April 2011 in Barcelona. Here’s the blurb:

Creativity is more important today than ever before. In fact, in current hypercompetitive environments, where the comparative advantage is easily eroded by technological evolution and by imitative or innovative action of competitors, firms can only react by means of creative processes aimed at renewing market strategies and product lines. Different streams of research on creativity have been developed over time, evolving from different sources, focusing on somewhat different aspects and suggesting a rich set of managerial results.

The aim of the workshop is to start an interdisciplinary debate on creativity, calling together contributors from psychology, sociology, management, and accounting domains. The discussion will explore the link between creativity and control, seen as a promising stream of research not only because of its infancy but most important because of its relevance to the world of management. The event will contribute to unveiling how the dialog between different disciplinary perspectives may lead to a deeper understanding on how to control creativity processes, thanks to the potential synergies deriving from the study of this phenomenon from different theoretical angles.

Further details and submission info below the fold. (more…)

Amsterdam Workshop on Entrepreneurial Capabilities

| Peter Klein |

The Amsterdam Center for Entrepreneurship (ACE) is sponsoring a two-day workshop starting tomorrow, 28 June, on “The Development of Entrepreneurial Capabilities.” Participants include Benson Honig, Gary Dushnitsky, Zoltan Acs, David Audretsch, Thomas Astebro, ACE Director Mirjam van Praag, and former O&M guest blogger Chihmao Hsieh. For more information see the conference program. Good stuff!

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Management Journal Impact Factors 2009

| Nicolai Foss |

Eugene Garfield may not exactly be defunct, but it is entirely tr ue that practical men, such as university presidents, deans, and department heads, are slaves of the Science Citation Index he created. In fact, so are the rest of us who have eagerly been waiting for the publication of the impact factors for 2009. They have just arrived and it is fascinating stuff. Here are a few immediate observations on the management IFs:

ue that practical men, such as university presidents, deans, and department heads, are slaves of the Science Citation Index he created. In fact, so are the rest of us who have eagerly been waiting for the publication of the impact factors for 2009. They have just arrived and it is fascinating stuff. Here are a few immediate observations on the management IFs:

- Abstracting from MIS Quarterly, the Strategic Management Journal is #3.

- Journal of Management is, at #5 (and #4 if MIS Q is left out) cementing its position as a top journal.

- Strategic Organization is up on #8! Way to go, Joel and colleagues! But can you sustain that position?

- Journal of International Business Studies has dropped a few positions but is still in the top-10.

- Journal of Management Studies (#14) has emerged as a close competitior in terms of ranking to Organization Science (#12). It is the undisputed #1 Euro management journal (it has also just entered the Financial Times ranking).

- Resarch Policy, which was among the top 10 only two years back, is now #22.

- Management Science is now down to #24. There are management departmetns where this journal is considered A+.

Of course, we all know the many reasons why all this should be taken with more than the proverbial grain of salt. For example, as Ram Mudambi points out (personal conversation), more and more journals play the impact factor game and force authors to cite recent papers in the journals, and reference lists grow longer and longer. Perhaps Article Influence Scores represent the superior alternative.

In the Pink

| Dick Langlois |

A propos Peter’s recent post about behavioral economics, I discovered this interesting video illustrating Daniel Pink’s book Drive (thanks, Steve). I don’t think there is anything about it that is particularly inconsistent with what we know about the economics of organization, but others may disagree.

I once heard Pink speak, at the 2002 Business History Conference meeting, just after his book Free Agent Nation (about the rise of self-employment) appeared. He was one third of a panel on the New Economy, the rest of which consisted of two extremely far-left twits. It was amusing to hear Pink, a former speechwriter for Al Gore, gamely hold up a sensible position, though I remember thinking what greater fun it would have been if they had invited Virginia Postrel.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Economics of Creativity

| Peter Klein |

David Galenson has written a series of papers on the creative arts, including songwriting, architecture, filmmaking, photography, and many kinds of visual art. A new paper, “Understanding Creativity,” summarizes and synthesizes much of this work. A central theme is the distinction between “experimental” and “conceptual” innovators. Experimental innovators focus on perception, proceed incrementally, and tend to make their most important contributions late in their careers. Conceptual innovators emphasize emotions, proceed in bold strokes, and tend to peak early. (A cinematic example: John Ford and Alfred Hitchcock fall in the former category, Orson Welles and Jean-Luc Godard in the latter.)

There are obvious parallels with the study of technological innovation, management, and entrepreneurship. Think of incremental versus systemic innovation, sustaining versus disruptive change, low-key management versus charismatic leadership, Kirznerian coordination versus Schumpeterian innovation. The analogies are inexact, but nonetheless intriguing (particularly the life-cycle aspects). What connections do you see?

The abstract of “Understanding Creativity” is below the fold. (The paper itself is gated, unfortunately). (more…)

Study this Summer with Klein

I’m participating in a distance-learning experiment this summer — no, not Bootsy Collins’s Funk University, but the Mises Academy, a new Mises Institute service offering short, non-degree courses to university students, management professionals, and the general public. Everything’s online — lectures, readings, discussions, assignments. I’m teaching “Entrepreneurship in the Capitalist Economy,” a course based on my favorite book (as Mankiw would put it). The course runs for 9 weeks from 7 June to 7 August and costs a mere $255 — that’s less than one or two of Nicolai’s books!

The course is pitched at the undergraduate/MBA level, with no formal prerequisites except intellectual curiosity, a good work ethic, and a sense of humor. Perhaps I’ll offer special extra-credit assignments for O&M readers. . . .

Drop me a line if you have any questions. I’d love to have you join me on this journey!

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Does Behavioral Economics Offer Anything New and True?

| Peter Klein |

One of my frustrations with behavioral economics is that it often seems to restate common, obvious, well-known ideas as if they are really novel insights (e.g., that preferences aren’t stable and predictable over time). More novel propositions are questionable at best (e.g, the paradox of choice).

Dan Ariely’s column in this month’s HBR is particularly frustrating. He claims as a unique insight of behavioral economics that when people are evaluated according to quantitative measures of performance, they tend to focus on the measures, not the underlying behavior being measured. Well, duh. This is pretty much a staple of introductory lectures on agency theory (and features prominently in Steve Kerr’s classic 1975 article). Ariely goes on to suggest that CEOs should be rewarded not on the basis of a single measure of performance, but multiple measures. Double-duh. Holmström (1979) called this the “informativeness principle” and it’s in all the standard textbooks on contract design and compensation structure (e.g., Milgrom and Roberts, Brickley et al., etc.) (Of course, agency theory also recognizes that gathering information is costly, and that additional metrics are valuable, on the margin, only if the benefits exceed the costs, a point unmentioned by Ariely.)

Ariely says firms should not evaluate CEO’s on stock price, but on a variety of measures. What, for example? Here the story gets a bit murky:

Ideally, they’d vary by industry, situation, and mission, but here are a few obvious choices: How many new jobs have been created at your firm? How strong is your pipeline of new patents? How satisfied are your customers? Your employees? What’s the level of trust in your company and brand? How much carbon dioxide do you emit?

Ariely seems unaware that stock price is the most frequently used measure of firm performance precisely because it is a composite measure that captures all of those things. Stock price reflects the best available information about current and expected future performance — products, jobs, customer satisfaction, etc. Is it a perfect measure? Hardly. But it isn’t obvious how owners or Boards can create their own quantitative, composite measure by by picking their favorite elements, proxies, weighting schemes, and so on, in a way that provides better overall assessments of performance than market valuations. Boards, after all, may be predictably irrational too.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Intro to The Capitalist and the Entrepreneur

| Peter Klein |

Here’s a nicely formatted HTML version of the introduction to The Capitalist and the Entrepreneur. I’d apologize for the self-promotion but, well, isn’t that the whole point of blogging?

(PS: Those of you who like to run your transactions through Amazon can get the book here. Not sure about a Kindle edition but I’m told an epub version will be available soon.)

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

The Capitalist and The Entrepreneur: Available Now!

| Peter Klein |

My new book, The Capitalist and the Entrepreneur: Essays on Organizations and Markets (Mises Institute, 2010), is now available. For a limited time, you can get it for just $15 — a bargain at half the price! Actually, the resource-constrained among you can read the Full Monty here, free of charge. A PDF version is also available. A promotional essay appears today on Mises.org.

My new book, The Capitalist and the Entrepreneur: Essays on Organizations and Markets (Mises Institute, 2010), is now available. For a limited time, you can get it for just $15 — a bargain at half the price! Actually, the resource-constrained among you can read the Full Monty here, free of charge. A PDF version is also available. A promotional essay appears today on Mises.org.

The editorial and production staff did a terrific job, and I’m thrilled with the volume’s look and feel. The contents aren’t bad either!

Order two or more and I will personally send you a set of Ginsu knives.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Personnel Economics Survey

| Peter Klein |

Paul Oyer and Scott Schaefer provide a helpful overview:

Personnel Economics: Hiring and Incentives

Paul Oyer, Scott Schaefer

NBER Working Paper No. 15977We survey the Personnel Economics literature, focusing on how firms establish, maintain, and end employment relationships and on how firms provide incentives to employees. This literature has been very successful in generating models and empirical work about incentive systems. Some of the unanswered questions in this area — for example, the empirical relevance of the risk/incentive tradeoff and the question of whether CEO pay arrangements reflect competitive markets and efficient contracting — are likely to be very difficult to answer due to measurement problems. The literature has been less successful at explaining how firms can find the right employees in the first place. Economists understand the broad economic forces — matching with costly search and bilateral asymmetric information — that firms face in trying to hire. But the main models in this area treat firms as simple black-box production functions. Less work has been done to understand how different firms approach the hiring problem, what determines the firm-level heterogeneity in hiring strategies, and whether these patterns conform to theory. We survey some literature in this area and suggest areas for further research.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Recent Comments