Posts filed under ‘Public Policy / Political Economy’

The Science of Design

| Peter Klein |

Rob King’s 2011 AAEA Presidential Address, “The Science of Design,” takes its cue from Herbert Simon.

[M]uch of what we do as economists is akin to what Simon calls natural science. We develop theories about how the economy works, and we conduct empirical studies that test these theories or estimate the parameters of key economic relationships that explain how general results derived from our theories manifest themselves in a particular context.We strive for results that explain what is or that predict what will be. . . .

Economists also design economic artifacts (e.g., markets, contracts, organizational structures, public policies) that reshape economic systems in order to better meet human needs. This work, which I will call economic design, is complementary with but differs fundamentally from economic analysis. While economic analysis is motivated by a question or a puzzle and focuses on explaining what is and predicting what will be, economic design is motivated by a problem or opportunity and focuses on what can be and ought to be or on what will yield a satisfactory outcome. . . .

While we are comfortable in recognizing “good science” in economic analysis, I believe we have devoted less attention to developing a shared understanding of “good science” in economic design.

It is certainly true that economists are increasingly involved in economic design (a trend that accelerated around WWII) though I am less sure this is a good idea. A lot of economic design — specifying “optimal” contracts, for example — might be considered the domain of entrepreneurs, not social scientists. But applied policy work is certainly of this character, so the essay may be read as a call for applied economists to pay closer attention to issues like decomposability, modularity, search, creativity, etc. (See Dick’s work for rich discussions of these issues.)

Kudos to Rob for a thoughtful and intelligent piece. A friend calls it “perhaps the most interesting President’s Address from AAEA in the last 20 years.”

The Economic Organization of Disaster Relief

| Peter Klein |

J. Vernon Henderson and Yong Suk Lee have released a fascinating study of the make-or-buy decision in the provision of disaster relief. “We distinguish four organizational structures by implementation method. . . . (1) donor-implementers who are NGO donors who do their own implementation in villages, (2) international implementers who represent different donors who choose not to do their own implementation, (3) domestic implementers hired by donors which have chosen neither to do their own implementation nor to hire an international implementer, and (4) a country level governmental organization . . . used primarily by domestic and foreign governments.” Henderson and Lee find that donor-implementers offer the highest-quality aid, and the government agency the lowest, with the contract implementers in-between. The framework is agency theory, not transaction cost economics, but there may be a role for asset specificity as well, particularly in cases where a longer-term commitment is required. In any case, this is an interesting and important application of organizational economics to an unconventional setting.

Strategy and Regulatory Uncertainty

| Peter Klein |

The Fall 2011 issue of California Management Review is a special issue on “Environmental Management and Regulatory Uncertainty.” I don’t think the authors have been reading Robert Higgs but they nonetheless offer some interesting perspectives on nonmarket strategy and political entrepreneurship. I look forward to future issues on Enron and Goldman Sachs (is it yet considered a branch of the Federal government?).

The Fall 2011 issue of California Management Review is a special issue on “Environmental Management and Regulatory Uncertainty.” I don’t think the authors have been reading Robert Higgs but they nonetheless offer some interesting perspectives on nonmarket strategy and political entrepreneurship. I look forward to future issues on Enron and Goldman Sachs (is it yet considered a branch of the Federal government?).

Entrepreneurial Paradoxes and Simulations

| Peter Lewin |

Back from the SEA meetings in Washington DC, the venue for our annual SDAE conference and membership meeting. At the annual banquet we honored Leonard Liggio for his contribution to the teaching of Austrian economics. Dick Wagner gave the presidential address. Both received a standing ovation.

The panels were well attended and, from what I could tell, the quality very high. I presented my paper on Entrepreneurial Paradoxes (which has been around for a while). Young Bak Choi commented on it and presented an interesting paper on the role of entrepreneurship in economic development and development policy. David Harper and Anthony Endres presented a paper on another variation on the theme of heterogeneous capital and its structure. Perhaps most interesting was a paper by a strategic management Ph.D candidate at York University, Mohammad Keyhani (co-authored with Moren Lévesque), on “The Role of Entrepreneurship in the Market Process: A Simulation Study of The Equilibrating and Disequilibrating Effects of Opportunity Creation and Discovery.” Randy Holcombe commented. Interesting that the issue of equilibration is considered important enough to investigate with simulations. But it raises some important questions. My own current view, having spent a lifetime contemplating the issue, is that we are no nearer an answer than we ever were, and that perhaps the more important distinction is between entrepreneurial actions that add value and those that do not.

Next year’s meetings will be in New Orleans. The president-elect of the SDAE is Larry White. He will be putting together the panels. So if you have an interest in presenting a paper, discussing one, or chairing a panel, let him know (lwhite11@gmu.edu).

“Poor Economics” Wins FT Best Book Award

| Peter Klein |

The Financial Times has named Abhijit Banerjee and Esther Duflo’s Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty the best business book of 2011. Here’s the book’s webpage. Here are previous O&M posts on the Banerjee-Duflo approach, which is obviously gaining momentum.

CFP: “Managing Wicked Problems: The Role of Multi-Stakeholder Engagements”

| Peter Klein |

O&M friend Brent Ross sends along this CFP for a track session of the 2012 Wageningen International Conference on Chain and Network Management. The session, “Managing Wicked Problems: The Role of Multi-Stakeholder Engagements for Resource and Value Creation,” is linked to a special issue of the International Food and Agribusiness Management Review. Info below the fold: (more…)

Can a Strong Central Government Credibly Commit Not to Intervene?

| Peter Klein |

When the subject is large financial or industrial companies, the answer is clearly no. Government promises not to rescue failing banks or large firms are cheap talk, not credible commitments. A central government strong enough to bail out politically connected organizations will bail them out; the only government that can credibly commit not to intervene is one that is not legally empowered to intervene. And no modern state is willing to give up that discretionary authority. Here is evidence from Korea:

Ending “Too Big To Fail”: Government Promises vs. Investor Perceptions

Todd A. Gormley, Simon Johnson, Changyong Rhee

NBER Working Paper No. 17518, October 2011Can a government credibly promise not to bailout firms whose failure would have major negative systemic consequences? Our analysis of Korea’s 1997-99 crisis, suggests an answer: No. Despite a general “no bailout” policy during the crisis, the largest Korean corporate groups (chaebol) – facing severe financial and governance problems – could still borrow heavily from households through issuing bonds at prices implying very low expected default risk. The evidence suggests “too big to fail” beliefs were not eliminated by government promises, presumably because investors believed that this policy was not time consistent. Subsequent government handling of potential and actual defaults by Daewoo and Hyundai confirmed the market view that creditors would be protected.

Anita McGahan at Missouri

| Peter Klein |

Friend of O&M and leading management scholar Anita McGahan will present the University of Missouri’s Monroe-Paine Distinguished Lecture in Public Affairs, “The Health of Humanity 2050,” Thursday, 27 October 2011. She’ll also do a faculty-student seminar, “Changing the World,” that morning. Besides her important contributions to industry and competitor analysis Anita has become a leading expert in public health, poverty, and economic growth. Local O&Mers, make plans to attend!

Monroe-Paine Distinguished Lecture in Public Affairs

You’re invited to attend

Dr. Anita McGahan

Associate Dean-Research, Director of the PhD Programs, Professor of Strategic Management and

Rotman Chair in Management, Rotman School of Management,

Munk School of Global Affairs, University of Torontowill present

“The Health of Humanity 2050”

October 27, 2011 — 1:30 pm

2501 Missouri Student Center, Chambers Auditorium

RSVP to McGahan Lecture

For more information on Dr. McGahan, please visit the Truman School website.

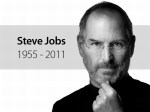

Dissing Apple, Loving Steve

Like so many others, I was deeply saddened to learn today about the passing of Steve Jobs. Jobs was a great entrepreneur, a visionary, a social benefactor. Business leaders like Steve Jobs do more good for humanity than most of the do-gooders put together.

In memory of Steve, Apple fans are sharing their memories of Apple products, listing how many Macs they’ve owned, reminiscing about their first Apple II the way they talk about their first kiss. I’m not one of those. Indeed, I don’t much care for Apple products. I used an Apple II as a teenager, and currently own an iPad, the only Apple product I’ve ever bought. Steve Jobs made a particular kind of device — beautiful, specialized, simple to operate, but expensive, impossible to customize, frustrating to use if you want to use it in a different way than Steve intended. That’s fine — à chacun son goût. Isn’t that the beauty of capitalism? Markets aren’t winner-take all. Neither Steve Jobs nor Bill Gates nor Linus Torvalds nor anyone else decided what products we all should use and made us use them. We didn’t vote for our favorite computer or music player or phone, then all get the one that 51% of the voters preferred. No, we can all have the goods and services we like.

I don’t like Apple products, but I love the fact that other people like them, and that people like Steve Jobs provided them. R.I.P.

Addendum: Steve Horwitz makes the same point.

Reader Bleg: Transaction Costs and the Boundaries of the State

| Peter Klein |

O&M reader VL asks:

I have noticed an interesting link between transaction cost economics and the explanation of the long-term political units size (as Braudel would have said, on “la longue durée”). For example, it is highly probable that classical Greek poleis were being integrated and desintegrated in response to changes in the nature of military and political contracts. I wish to explore that perspective in my own doctoral thesis and I would like to ask for your help. Do you know about any work that examines that matter? I have read books of Coase, Williamson, and North, and further articles of Alchian, Demsetz, and others. But I don’t know of any work treating organization economics from a political anthropological or political historical perspective.

I suggested privately that he look at David Friedman’s 1977 JPE paper and recent work by Alberto Alesina and coauthors, though none of these works from a transaction cost perspective. Can the rest of you offer some suggestions? If not TCE, then how about resource-based, dynamic capabilities, or property-rights perspectives on the boundaries of the polis?

And Your Chicks for Free

| Peter Klein |

Fred McChesney, call your office.

Hoping to fend off any antitrust action, Google has hired at least 13 lobbying and communications firms since May, when the Federal Trade Commission ramped up its probe of the Internet giant. Firms led by figures from both parties — including former House Democratic leader Richard Gephardt and the son of Indiana Republican Sen. Richard Lugar — are going to bat for the company.

Gentlemen, don’t forget to close that revolving door on your way out. . . .

BTW for an interesting, if somewhat confused, take on the antitrust industry, see a young Robert Reich.

Pirrong on Regime Uncertainty

| Peter Klein |

A nice post from former guest blogger Craig Pirrong on regime uncertainty and its role in hampering economic recovery. As Craig points out, it’s not the level of government intervention per se that delays investment, but uncertainty about anticipated changes in government intervention. Options theory provides a useful way to see this.

A nice post from former guest blogger Craig Pirrong on regime uncertainty and its role in hampering economic recovery. As Craig points out, it’s not the level of government intervention per se that delays investment, but uncertainty about anticipated changes in government intervention. Options theory provides a useful way to see this.

Bob Higgs approves. And here are Craig’s old O&M posts.

Two Interesting and Different Strategies for Tie-in

| Peter Lewin|

I have an all-in-one color printer, fax, scanner (Canon MX7600). It is pricey, but the real kicker is the cost of the toner. It uses 6 different cartridges. Some of them run out pretty frequently. Each costs around $20, basically for a small container of ink. When any one of the cartridges runs out the machine shuts down — though it could easily print black and white when one of the colors runs out. Also, and this is the interesting thing, when any toner cartridge runs out all of the other functions of the machine shut down — no outgoing faxes, no scanning — even though these have nothing to do with printing. This way I am inclined to replace the cartridge sooner rather than later. Annoying. I suspect this is deliberate and maybe not enough of a nuisance to be a selling point in the competition for consumers.

Very different: I am running out of my blood-pressure medicine. I have my own blood pressure machine, and as horrendously complicated as it is to use it, I have somehow managed to master the art. My blood pressure is normal while on the medication. I attempt to refill the prescription (which costs $12 without insurance — not even worth claiming). No refills left. The pharmacy calls the doctor. The doctor’s office calls me to make an appointment. For what? To get my blood pressure taken. I have my own machine. That is not good enough. We have to do it! My appointment is at 10:45. I see the nurse at 11:15, after filling out paperwork that I have filled out multiple times before. I see the doctor at 11:45. I leave the doctor’s office at 12:05 after he has sent in my refill prescription. I pay him $30 copay. The insurance pays him about $150 for an office visit. Do the math to see how much this $12 prescription cost me (include the opportunity cost of my time and the cost of the office visit — which is reflected in my insurance premium). This ability to tie-in the purchase of a prescribed medicine with the purchase of an office visit is a massive social cost that we all face. It is the result of the non-market delivery of health-care.

Are Ray-Guns “Idle Resources”?

| Peter Klein |

| Peter Klein |

Several people have called to my attention this extraordinary interview in which Paul Krugman states his belief that a military buildup to fight a mythical alien invasion would pull the economy out of recession. I guess it would be more entertaining than paying people to dig holes in the ground and paying other people to dig them up. Were Krugman’s remarks tongue-in-cheek? Unlikely, as he seems to believe in a sort of old-school, 1950s-era, hydraulic Keynesianism, and hasn’t otherwise demonstrated a sense of humor.

Of course, as Bob Higgs has tirelessly demonstrated, World War II didn’t end the Great Depression, but that doesn’t stop this canard being trotted out every time someone wants to justify deficit spending. Notes Mary Theroux: “the Great Depression ended in 1946, when 10 million individuals were returned to the ranks of the unemployed, and federal spending plunged 40% in the aftermath of FDR’s death and the abandonment of the New Deal.” But the more fundamental point is that spending for spending’s sake does not increase economic well-being. To see why, we must challenge the core Keynesian concept of “idle resources,” the idea that, when the economy is away from “full employment,” the usual laws of microeconomics — resources are scarce, decision-makers face tradeoffs at the margin, costs are opportunity costs — don’t apply. As Brad Delong recently put it in one of his characteristically classy missives: during a recession, “[t]he full-employment world of Bastiat is very very far away.” Of course, Bastiat’s brilliant demonstration of hidden costs and the fallacy of spending one’s way into prosperity has nothing to do with “full employment,” a concept that isn’t even coherent, given that efficiency in resource employment makes sense only with regard to the subjective production plan of the entrepreneur (cf. Penrose, 1959; Kirzner, 1966).

W. H. Hutt’s powerful and underappreciated critique of Keynes, The Theory of Idle Resources (1939) — available for free download at Mises.org — attacks this core Keynesian concept. As Hutt explains, all resources have alternative uses, and even “idleness” is a use, in the sense that the resource owner prefers to hold the resource for a future, as-yet-unavailable or unimagined use — a real option, if you like. Dragooning such resources into some random use, outside the price mechanism, serves no productive purpose. Even outside the mythical world of “full employment,” there are no free lunches.

So put those ray-guns back into storage, boys. We may need them later.

Entrepreneurship in Africa

| Dick Langlois |

Inspired by Peter Lewin’s recent post on the beauty of Africa, I decided to hop on a plane to Peter’s native South Africa. I haven’t been to a wildlife park, though I have found myself twice down in caves, one containing fossils and one a disused gold mine. I also took in the Apartheid Museum, which seemed to me (as an outsider) to be extremely well done. It didn’t pull any punches but always appeared neutral, even analytical. For me, the museum’s story underscored the point that Walter Williams and others always used to argue while apartheid was going on: that the system required, and was implemented through, central planning and massive government intervention in markets. (Apparently they even had a wacky scheme to move people from their distant segregated homes to and from urban work using high-speed bullet trains.) I was struck by how similar the revolution here was to the contemporaneous one in Eastern Europe. It was a revolt by a middle class that was denied human and political rights — and also economic opportunity — by an increasingly inefficient and distortive state apparatus.

A couple of exhibits at the Apartheid Museum asserted that in the heyday of gold mining the British had “fixed the price of gold.” This price fixing forced the mine owners constantly to lower production costs, which they did by deskilling mining operations – using technology to break the process into simpler tasks (Ames and Rosenberg 1965) — in order to hire cheaper labor. By contrast, the mining museum suggested that there was plenty of skill-enhancing innovation as well, like pneumatic drills replacing the hammer and chisel, which reduced from eight hours to five minutes the time it took a worker to carve out a blasting hole.

Oddly, neither museum mentioned that gold was the monetary standard. (You know this already: it’s not that the “price of gold” was fixed; it’s that the value of the currency was defined in terms of units of gold.) This might sound like an economist’s carping. But I mention it because on this trip I also encountered the strange combination of task design and monetary economics in a strikingly different African context. I’m actually in south Africa not primarily for the tourism (at least in principle) but to visit Giampaolo Garzarelli and his Institutions and Political Economy Group at the University of the Witwatersrand and, as Peter Klein mentioned in an earlier post, to attend a conference on “Open Source, Innovation, and New Organizational Forms,” which took place on Monday. Joel West, another of the participants, has already blogged elsewhere about the conference. One paper, by an MA student from Kenya – Joel has already blogged about this as well – discussed an amazing phenomenon I had never heard about before: crowdsourcing in developing countries using mobile phones. A company called txteagle allows customers to outsource cognitive work by breaking tasks into small pieces, which pieces are then sent to participants via text message. (As phones have become cheaper they have become ubiquitous in the developing world.) For example, the participant could be asked to translate a phrase into his or her local language or to transcribe a voice snippet. The txteagle computers then aggregate the output and use redundancy and artificial intelligence to validate the results. The participant is paid for the task, via the same mobile phone, using M-Pesa, a system I first heard about only a couple of weeks ago. Interestingly, M-Pesa is itself a formalization of a spontaneous monetary system – think cigarettes at a prison camp – in which people without access to banks would save and transact in airtime minutes. The amount a participant can earn in this system is quite meaningful in the context of poor countries with high unemployment.

Rogoff on Leverage

| Peter Klein |

An important point from Ken Rogoff:

Many commentators have argued that fiscal stimulus has largely failed not because it was misguided, but because it was not large enough to fight a “Great Recession.” But, in a “Great Contraction,” problem number one is too much debt. If governments that retain strong credit ratings are to spend scarce resources effectively, the most effective approach is to catalyze debt workouts and reductions.

For example, governments could facilitate the write-down of mortgages in exchange for a share of any future home-price appreciation. An analogous approach can be done for countries. For example, rich countries’ voters in Europe could perhaps be persuaded to engage in a much larger bailout for Greece (one that is actually big enough to work), in exchange for higher payments in ten to fifteen years if Greek growth outperforms.

I don’t agree with all of the discussion, for example Rogoff’s call for price inflation to mitigate the burden on debtors, but this is a big advance over the vulgar Keynesianism that passes for analysis at the New York Times. (See also Peter L.’s post on Rumelt.) The main point is that a recession like the present one is structural, and has nothing do with shibboleths like “insufficient aggregate demand.” I wish Rogoff (here or in his important book with Carmen Reinhart) talked about credit expansion as the source of structural, sectoral imbalances that generate macroeconomic crises.

A Krugmanian Slasher Flick

| Peter Klein |

| Peter Klein |

Paul Krugman is furious about the deficit-reduction plan reportedly agreed to yesterday, which Krugman says will “slash government spending,” introducing “big spending cuts” that “will depress the economy even further.” And yet, the deal apparently does not cut one penny of government expenditures, but simply increases them at a slower pace (over ten years) than originally projected by the CBO. Remember, in Washington-speak, “cut” means “reduction in the planned rate of increase.”

Imagine a scene from a Krugman-style slasher flick: the villain approaches the victim, and gives him a smaller hug than the victim was expecting! The audience gasps as the victim screams in terror and flees from the vicious attack.

Sovereign States Default, Repudiate; Sun Still Rises

| Peter Klein |

Frivolous commentary on the US debt crisis (like this) attributes to opponents of raising the debt ceiling the view that “defaults don’t matter.” Sensible people recognize, of course, that default (and even repudiation) are policy options that have benefits and costs, just as continuing to borrow and increasing the debt have benefits and costs. Reasonable people can disagree about the relevant magnitudes, but comparative institutional analysis is obviously the way to go here. (Unfortunately, most of the academic discussion has focused entirely on the possible short-term costs of default, with almost no attention paid to the almost certain long-term costs of continued borrowing.)

I’m a bit surprised no one has brought up William English’s 1996 AER paper, “Understanding the Costs of Sovereign Default: American State Debts in the 1840’s,” which provides very interesting evidence on US state defaults. It’s not a natural experiment, exactly, but does a nice job exploring the variety of default and repudiation practices among states that were otherwise pretty similar. Here’s the meat:

Between 1841 and 1843 eight states and one territory defaulted on their obligations, and by the end of the decade four states and one territory had repudiated all or part of their debts. These debts are properly seen as sovereign debts both because the United States Constitution precludes suits against states to enforce the payment of debts, and because most of the state debts were held by residents of other states and other countries (primarily Britain). . . .

In spite of the inability of the foreign creditors to impose direct sanctions, most U.S. states repaid their debts. It appears that states repaid in order to maintain their access to international capital markets, much like in reputational models. The states that repaid were able to borrow more in the years leading up to the Civil War. while those that did not repav were, for the most part, unable to do so. States that defaulted temporarily were able to regain access to the credit market by settling their old debts. More surprisingly, two states that repudiated a part of their debt were able to regain access to capital markets after servicing the remainder of their debt for a time.

Amazingly, the earth did not crash into the sun, nor did the citizens of the delinquent states experience locusts, boils, or Nancy Grace. Bond yields of course rose in the repudiating, defaulting, and partially defaulting states, but not to “catastrophic” levels. There were complex restructuring deals and other transactions to try to mitigate harms.

A recent CNBC story on Europe cited “the realization that sovereign risk, and particularly developed market sovereign risk exists, because most developed world sovereign was basically treated as entirely risk free,” quoting a principal at BlackRock Investment Institute. “With hindsight, we can say . . . that they have never been risk free, it’s just that we have been living in a quiet time over the last 20 years.” Doesn’t sound like Apocalypse to me.

Asset Sales and Financial Distress

| Peter Klein |

“What is prudence in the conduct of every private family can scarce be folly in that of a great kingdom,” Adam Smith famously observed. I noted in an earlier post on raising the debt ceiling that restructuring US government securities is hardly the “nuclear” option it’s portrayed in the pundit world; bankrupt firms, like bankrupt families and firms, restructure their debt obligations all the time. The notion of T-Bills as a sort of sacred relic, to be once and forever “risk-free,” seems more like religion than economics to me.

But, more important, there is another option for entities struggling to make their interest payments: asset sales. Just in the last couple days Bob Murphy, David Friedman, and Steve Horwitz have made this point. Public discussion on the US debt crisis assumes that the only options for meeting US debt obligations are increasing taxes, cutting spending, or both. But asset sales are another viable option. There’s a huge literature on this in corporate finance (e.g., Shleifer and Vishny, 1992; Brown, James, and Mooradian, 1994; John and Ofek, 1995), exploring the benefits and costs of asset sales as a source of liquidity for financially distressed firms. Of course, selling assets under dire circumstances, at fire-sale prices, is far from a first-best option but, as this literature points out, often better than bankruptcy or liquidation. (One of the best-known results, from John and Ofek, is that asset sales tend to increase firm value when they result in an increase in focus. Would it really be so bad if the US government sold off some foreign treasuries and currency, the strategic petroleum reserve, its vast holdings of commercial land, and other elements of a highly diversified, and unaccountably bloated, portfolio?)

Recent Comments