Chameleon Models and Their Dangers

| Nicolai Foss |

Here is a new paper by major Stanford finance scholar, Paul Pfleiderer on what he calls “chameleon models” and their misuse in finance and economics. Lots of catchy concepts, e.g., “theoretical cherry picking” and “bookshelf models,” and an fine critical discussion of Friedmanite instrumentalism. The essence of the paper is this:

Chameleons arise and are often nurtured by the following dynamic. First a bookshelf model is constructed that involves terms and elements that seem to have some relation to the real world and assumptions that are not so unrealistic that they would be dismissed out of hand. The intention of the author, let’s call him or her “Q,” in developing the model may to say something about the real world or the goal may simply be to explore the implications of making a certain set of assumptions. Once Q’s model and results

become known, references are made to it, with statements such as “Q shows that X.” This should be taken as short-hand way of saying “Q shows that under a certain set of assumptions it follows (deductively) that X,” but some people start taking X as a plausible statement about the real world. If someone skeptical about X challenges the assumptions made by Q, some will say that a model shouldn’t be judged by the realism of its assumptions, since all models have assumptions that are unrealistic. Another rejoinder made by those supporting X as something plausibly applying to the real world might be that the truth or falsity of X is an empirical matter and until the appropriate empirical tests or analyses have been conducted and have rejected X, X must be taken seriously. In other words, X is innocent until proven guilty. Now these statements may not be made in quite the stark manner that I have made them here, but the underlying notion still prevails that because there is a model for X, because questioning the assumptions behind X is not appropriate, and because the testable implications of the model supporting X have not been empirically rejected, we must take X seriously. Q’s model (with X as a result) becomes a chameleon that avoids the real world filters.

Doux Commerce Bleg

| Nicolai Foss |

Andrew Smith, University of Liverpool Management School asks for the help of the readers of O&M:

I’m currently exploring the literature on the theory of the capitalist peace. I’m very familiar with the vast literature by IR scholars and political economists on the theory of the capitalist peace/commercial peace (i.e., the idea that commercial interdependence among nations reduces the likelihood of warfare). This literature is dominated by works using panel data (e.g., Gartzke, 2007).

What I need to find out more about is the literature on the possible microfoundations of the capitalist peace—i.e., work by psychologists and experimental economists on whether repeated participation in inter-ethnic and international trade actually influences the cognitive processes of the individuals involved and makes them less warlike. Does experience with economic exchange with non-members of the group (family, clan, tribe, nation, etc) make people more pacific? Does it make individuals less violent? Montesquieu speculated that this would be the case a long time ago when he advanced his “doux commerce” thesis. Albert Hirschman said that Montesquieu’s theory was the conventional wisdom in the Enlightenment. However, I’m interested in what modern social scientists have said about this theory. Francois and van Ypersele (2009) found that level of trust reported by adults in the US is positively correlated with the competitiveness of the sector in which they work. Their research was not about international economic relations and diplomacy. However, it does tend to support the thesis that a competitive market economy has a civilizing influence. I would be interested in knowing if there is other research by psychologists, experimental economists, and others that is relevant to the doux commerce thesis.

Contracts as Technology

| Peter Klein |

That’s the title of an interesting new law review article by Kevin Davis (New York University Law Review, April 2013). Just as we can treat organizational structure as as sort of technology, and study the introduction and diffusion of new organizational forms with the same theories and methods used to study technological innovation and diffusion, we can think of contracts as structures or institutions that emerge, are subject to experimentation and competition, and evolve and diffuse. Here’s the abstract:

If technology means, “useful knowledge about how to produce things at low cost”, then contracts should qualify. Just as mechanical technologies are embodied in blueprints, technologies of contracting are embodied in contractual documents that serve as, “blueprints for collaboration”. This Article analyzes innovations in contractual documents using the same kind of framework that is used to analyze other kinds of technological innovation. The analysis begins by laying out an informal model of the demand for and supply of innovative contractual documents. The discussion of demand emphasizes the impact of innovations upon not only each party’s incentives to collaborate efficiently, but also upon reading costs and litigation costs. The analysis of supply considers both the generation and dissemination of innovations and emphasizes the importance of cumulative innovation, learning by-doing, economies of scale and scope, and trustworthiness. Recent literature has raised concerns about the extent to which law firms produce contractual innovations. In fact, a wide range of actors other than law firms supply contractual documents; including end users of contracts, specialized providers of legal documents, legal database firms, trade associations, and academic institutions. This article discusses the incentives and capabilities of each of these potential sources of innovation. It concludes by discussing potential interventions such as: (1) enhancing intellectual property rights, (2) relaxing rules concerning the unauthorized practice of law and, (3) creating or expanding publicly sponsored clearinghouses for contracts.

See also Lisa Berstein’s comment. (HT: Geoff Manne)

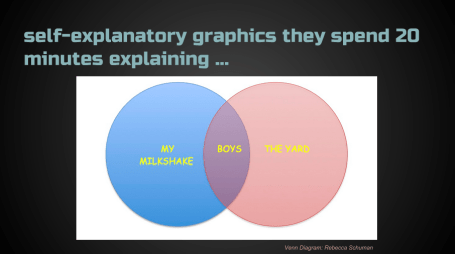

“PowerPointless”

| Peter Klein |

A clever and funny entry for our ongoing series on the use and abuse of PowerPoint. It’s aimed at classroom presentations but applies, a fortiori, to any professional meeting, including (especially?) academic conferences. I especially appreciate this:

If your audience can understand everything it needs to from your slide show only, . . . cut out about 50 percent of the slides and 90 percent of the text. . . . Your slide show by itself should be incomprehensible. Because, to paraphrase Ludwig Wittgenstein, its most important part is what’s not on it. (I.e., you actually talking with people.)

I have a few quibbles, e.g., I generally avoid animations (having each point appear only as you mention it), but overall this is great advice, amusingly illustrated.

Epistemic Mind Games

| Dick Langlois |

I had a brief mental hiccup today when I received an email advertisement from Stanford University Press for a book called Epinets: The Epistemic Structure and Dynamics of Social Networks by Mihnea C. Moldoveanu and Joel A. C. Baum. Because the ad carried prominently the SUP logo — a stylized fir tree — and because epinette is the Canadian French word for spruce tree, I thought for a nanosecond that I was being offered a treatise on conifer biology, penned by a man whose name means “tree.” But no. It’s a book of organizational sociology. “Drawing on artificial intelligence, the philosophy of language, and epistemic game theory, Moldoveanu and Baum formulate a lexicon and array of conceptual tools that enable readers to explain, predict, and shape the fabric and behavior of social networks.” Might be worth glancing at, if only to find out what epistemic game theory is. (Perhaps it is as opposed to ontological game theory.)

Of course, the Palo Alto of the Stanford seal is not a spruce. It’s a coast redwood, also called a sequoia.

Temporary versus Permanent Behavioral Responses

| Peter Klein |

As a behavioral economics skeptic I was intrigued by a recent NBER paper on worker responses to a change in the employment contract. Rajshri Jayaraman, Debraj Ray, and Francis de Vericourt studied an Indian tea plantation that changed its employment contract to weaken pay-for-performance incentives and found, initially, a substantial increase in output, suggesting a “happy-is-productive” effect that would make the pop psychologists proud. “This large and contrarian response to a flattening of marginal incentives is at odds with the standard model, including one that incorporates dynamic incentives, and it can only be partly accounted for by higher supervisory effort. We conclude that the increase is a ‘behavioral’ response.”

Alas, the effect was only temporary, becoming entirely reversed within a few months:

In fact, an entirely standard model with no behavioral or dynamic features that we estimate off the pre-change data, fits the observations four months after the contract change remarkably well. While not an unequivocal indictment of the recent emphasis on “behavioral economics,” the findings suggest that non-standard responses may be ephemeral, especially in employment contexts in which the baseline relationship is delineated by financial considerations in the first place. From an empirical perspective, therefore, it is ideal to examine responses to a contract change over an substantial period of time.

This looks to me like a Hawthorne effect. Given that much of the empirical literature in behavioral social science uses relatively short time horizons, I wonder how many of the findings can be explained this way? How many key “behavioral” results are short-term responses to changing management practices, workplace conditions, the employment contract, etc., rather than indicators of something more substantial about human behavior and motivation?

WINIR Conference in Greenwich: Deadline Approaching

| Dick Langlois |

February 28 is the deadline for submitting an abstract to the first conference of the World Interdisciplinary Network for Institutional Research (WINIR), which will take place 11-14 September 2014 at the Old Royal Naval College, Greenwich. Keynote speakers include Timur Kuran. Information and abstract submission at the WINIR website.

Cheating and Public Service

| Dick Langlois |

Everyone knows that people who want to go into government jobs have high pro-social preferences and impeccable honesty. Well, not so in India, according to Rema Hanna from the Kennedy School at Harvard, who spoke in our department seminar series Friday. Here is the abstract:

In this paper, we demonstrate that university students who cheat on a simple task in a laboratory setting are more likely to state a preference for entering public service. Importantly, we also show that cheating on this task is predictive of corrupt behavior by real government workers, implying that this measure captures a meaningful propensity towards corruption. Students who demonstrate lower levels of prosocial preferences in the laboratory games are also more likely to prefer to enter the government, while outcomes on explicit, two-player games to measure cheating and attitudinal measures of corruption do not systematically predict job preferences. We find that a screening process that chooses the highest ability applicants would not alter the average propensity for corruption among the applicant pool. Our findings imply that differential selection into government may contribute, in part, to corruption. They also emphasize that screening characteristics other than ability may be useful in reducing corruption, but caution that more explicit measures may offer little predictive power.

I wonder what her colleagues at the Kennedy School think of this. Ask not what you can do for your country; ask what your country can do for you.

Entrepreneurship and Networks Workshop at CBS

| Nicolai Foss |

My colleagues at the Dept of Strategic Management and Globalization at the Copenhagen Business School, Louise Mors, Mia Reinholdt Fosgaard and Lisa Gärber are arranging an exciting workshop, “Micro Foundations of Social Networks and the Implications for Strategy and Entrepreneurship Research,” on June 12-13. The workshop takes place at CBS and has luminaries like Ron Burt and Martin Kilduff as keynote speakers. (The SMS special conference on “Microfoundations of Strategic Management Research: Embracing Individuals“, begins when the workshop ends, so you may combine the two). This may be of interest to, say, Austrians who seek to add some theoretical and empirical meat to the skeleton of Kirznerian alertness and discovery and who recognize links between these notions and, for example, notions of brokerage in networks.

The Theory of Mind in Agency Theory

| Nicolai Foss |

Agency theory is a highly important foundational theory in management research. It has been of great assistance with respect to conceptualizing and framing key problems in the design and management of reward systems, and it yields sharp and clear predictions. However, it does not provide a realistic treatment of a key psychological aspects of interpersonal relations. Specifically, agency theory does not adequately account for the principal’s ability to develop, hold and adjust a “theory of the agent’s mind”. The theory in fact contains a very lopsided account of the principal’s ability to read the agent’s desires, intentions, knowledge, and beliefs. Thus, in many models in agency theory, the principal’s knowledge of much of what is “inside the head” of the agent (e.g., the agent’s taste for risk, opportunity costs, and disutility of work) is assumed to be perfect, while he is assumed to be entirely ignorant of other aspects of what the agent intends, knows and believes. Such “asymmetrical” assumptions allow for analytical tractability and clean predictions regarding how incentives and monitoring influences the behavior of agents, such as employees, managers, and suppliers. However, extreme and asymmetrical assumptions can also lead more applied research astray and lead to misapplications of theory in managerial practice. Thus, the assumption that a principal is capable of perfectly grasping, for example, an agent’s motivations seems highly, and increasingly, tenuous: High personnel turnover and the increasing use of fleeting project organization in many industries, as well as the increasing prevalence of cross-national and cross-cultural management teams and networks, make an assumption of a perfect ToM unrealistic.

In a new paper, “Putting a Realistic Theory of Mind Into Agency Theory: Implications for Reward Design and Management in Principal Agent Relations,” my CBS colleague Diego Stea and I take some initial and highly exploratory steps towards working with a more realistic theory of mind in the context of agency relationships within firms (in an as yet unpublished modelling paper, we work these ideas into an adverse selection model). We argue that novel insights into the design and management of rewards follow from explicitly incorporating a realistic theory of mind into agency theory. Thus, a principal with a good theory of mind can better learn the type of the agent, read the signals related to the agent’s effort, signal to the agent, and adjust rewards to the agent. A ToM creates value because it results in lower-variance estimates of the agent’s effort and type, and eases the matching of agents with contracts.

Micro-foundations Happening: Strategic Human Capital

| Nicolai Foss |

After about a decade of methodological discussion (involving some preaching on both sides of the debate), the micro-foundations project in macro-management research is now beginning to take off in the “doing” dimension. Specifically, scholars are building micro-foundational theory and they are wrestling with the empirical challenges in the micro-foundations. The theoretical and empirical challenges largely derive from the inherent multi-level nature of the micro-foundations project. Theory-building cannot just be somehow moving, say, individual-level organizational behavior insights to the organizational level, but must be genuinely multi-level which raises tricky issues of aggregation and downward causation. Data sampling will necessarily have to take place at at least two levels. This is complicated and usually expensive. Access to good micro-level data is particularly troublesome (one of the advantages of living in a socialist country like Denmark is that the Big Nanny literally looks after her children: We have register data that is incredibly detailed regarding human capital dimensions (i.e., not just gender, age, education, etc., but also complete job history, school and university grades , criminal record, household income, history of medication, etc. — and this is for each and every employee in the DK economy)).

One of the areasis in which the micro-foundations project is being realized in the theoretical and empirical dimensions is what is increasingly often referred to as “strategic human capital.” This is an emerging field (it has its own interest group at the Strategic Management Society) that is quite overlapping with “strategic human resource management,” and which links strategic management, traditional SHR and HR, and human capital theory. The February special issue of Journal of Management, expertly edited by Patrick Wright, Russ Coff and Thomas Moliterno, three key drivers in the SHRM/SHC field, contains ten fine papers on SHC. The introductory essay by the editors nicely lays out the main challenges and issues. Many of the challenges are quite “low-practical” — e.g., people trained in strategy focus a lot on endogeneity, where HR and OB people focus a lot on construct validity issues that strategy folks care less about. Yet, such differences may be quite decisive–as the editors learned while handling the review process! The editors also deal with key issues, such as what are the important dimensions of human capital for the purposes of the SHM field, how can human capital be characterized at different analytical levels, and what are the antecedents and consequences of human capital. I look forward to sinking my teeth into the research articles in the coming week.

CFP: Coase Memorial Issue of Man and the Economy

| Peter Klein |

An important announcement from Ning Wang, editor of Man and the Economy:

Man and the Economy

Call for Papers for a Special Issue in Memory of Ronald Coase“R. H. Coase: The Man and His Ideas”

Man and the Economy will devote a special issue (December 2014) to the life and ideas of Ronald Coase, the 1991 Nobel Laureate in Economics and Founding Editor of this journal. During his long academic life, Coase devoted himself to economics, which, in his view, should investigate how the real world economy works, with all its imperfections. Coase viewed and practiced economics as a social science, a study of man creating wealth in society through various institutional arrangements. To honor the memory of Coase, we welcome original research articles that extend and develop the Coasian economics, including empirical studies of the structure of production and exchange. We also welcome critical and constructive commentaries that clarify and elaborate the Coasian themes, from a law-and-economics/new institutional economics perspective, which include, but not limited to, topics on transaction costs, property rights, theories of the firm and China’s economic transformation. In addition, we also welcome personal reflections and reminiscences of Coase as a colleague, a teacher, an editor, and/or a friend.

Submissions must be made online via the Journal’s website: http://www.degruyter.com/view/j/me

Deadline for submissions is September 30, 2014.

More on Business Model Innovation

| Nicolai Foss |

I am intrigued by notions of “business models” and “business model innovation.” Many academics dismiss these notions, arguing that they are too fluffy or too much overlapping with established thinking in strategic management. I understand both objections, but still think there is something to these notions. Specifically, they capture the need for integration of and coherence among strategic choices related to value proposition, segments, value appropriation models, and value chain organization in a way that I don’t see clearly reflected in mainstream strategy thinking. And yet, it is also clear that the basic unit of analysis, the busines model, remains un-dimensionalized, even though business models and the innovation thereof clearly differ–and therefore pose different leadership, management and organizational design challenges. In other words, extant research does not adequately represent the heterogeneity of business models (innovation), and therefore does not dimensionalize them.

In a new paper, Nils Stieglitz and I argue that a key dimension along which business models (and hence the innovation thereof) differ is the strength of the interdependences, or, complementarities, between their constituent components. Thus, some business model innovations are more modular, while others are more architectural. Also, business model innovations can be dimensionalized in terms how radical they are. We argue that leadership challenges systematically depend on the nature of the relevant business model innovation. To our knowledge this is the first dimensionalization exercise in the literature and the first attempt at building a contingency theory of business model innovation.

Property Rights Economics — Mark I and Mark II

| Nicolai Foss |

In modern standard economics, property rights as an analytical category are mainly associated with the work of Oliver Hart, largely because of his important work, with Sanford Grossman, John Moore and others, on asset ownership in the context of the boundaries of the firm (the pioneering paper is here). Many modern (younger) economists don’t seem to know of the older property rights tradition, associated with Coase, Alchian, Demsetz, Cheung, Barzel, Furubotn, Umbeck, Alston, Libecap, Eggertson et al. Given the prevalent Whig interpretation of the evolution of economic theory, one may be led to the belief that the modern approach superseded or incorporated everything that was sound in the older, verbal approach, while advancing property rights thinking in rigorous game-theoretical terms.

With a frequent co-author, I have penned a paper, “Coasian and Modern Property Rights Economics: A Case of Kuhnian Lost Content,” that argues that such a view is false. In fact, we argue that there has been something akin to a Kuhnian “loss of content” (Kuhn, 1996) in the move from Mark I to Mark II property rights economics. What we call “property rights economics Mark II” is a more narrow approach in terms of the phenomena that are investigated, namely why it matters who owns the asset(s) in a relation that spans at least two stage of production in a value chain. In contrast, “property rights economics Mark I” was taken up with the complex and contingent nature of real ownership arrangements, and pointed to the many margins on which individual can exercise capture of rights, how they seek to protect their rights, the resources consumed in this process, and the role of institutions in facilitating and constraining such processes. This institutional research program is considerably richer than the one implied by Mark II property rights economics.

Relational Contracts and the Decline of General Motors

| Nicolai Foss |

The shifting fortunes in the international automobile industry over the last four decades have, for obvious reasons, been endlessly commented upon. Usually, the two leading protagonists in the various accounts of the dynamics of the industry are General Motors and Toyota, the former because of its conspicuous decline (GM’s share of the US market dropped from about 60 to about 20% over a 30 years period), the latter because it has been steadily growing and is now the world’s largest automaker.

Discussions of the relative performance of these two industrial giants sometimes focus on vacuous categories like “culture” and “capabilities.” More detailed accounts stress the short-termism of General Motor’s investment decisions, its arms-length supplier relations, and its obsession with narrowly defined, easily-measurable jobs. Toyota’s relative success is often explained in terms of the Toyota Management Model with its emphasis on broadly defined jobs, intensive lateral and vertical information flows, and emphasis on problem-solving on the shop floor. However, it is not immediately clear that GM did something very badly that Toyota did very well. The liabilities that led to the decline of GM were apparently were different from the assets that brought Toyota success.

In a new NBER paper, “Management Practices, Relational Contracts, and the Decline of General Motors“, Susan Helper and Rebecca Henderson argue, however, that GM and Toyota are directly comparable in terms of the relational contracts existing inside their corporate hieararchies and across the boundaries of these two companies, and that their differential performance is explainable in terms of the differences between the contracts. Relying on recent contract theory research on relational contracts (rather than the older, but neglected work of Harvey Leibenstein), Helper and Henderson reject a number of conventional explanations (e.g., that GM’s investment policy was oriented towards the short term), and convincingly argue that GM had difficulties understanding the nature and important role of relational contracts behind Toyota’s success and therefores truggled to implement similar relational contracts. They point to a number of reasons why relational contracts may be difficult to build, centering on problems of creating credible commitments and communicating clearly and suggest that these problems were rampant in GM. In all, a very nice read that can be used in a number of different classes (org theory, economics of the firm, strategic management). Highly recommended!

UPDATE: My colleague Henrik Lando draws my attention to Ben-Shahar and White’s 2005 paper on manufacturing contracts in the auto industry which tells a story that is consistent with the Helper and Henderson story. Here.

What Are “Transaction Costs” Anyway?

| Peter Klein |

A friend complains that management and entrepreneurship scholarship is confused about the concept of transaction costs. Authors rarely give explicit definitions. They conflate search costs, bargaining costs, measurement costs, agency costs, enforcement costs, etc. No one distinguishes between Coase’s, Williamson’s, and North’s formulations. “Transaction costs seem to be whatever the author wants them to be to justify the argument.”

It’s a fair point, and it applies to economics (and other social sciences and professional fields) too. I remember being asked by a prominent economist, back when I was a PhD student writing under Williamson, why transaction costs “don’t simply go to zero in the long run.” Indeed, contemporary organizational economics mostly uses terms like “contracting costs,” and since 1991 Williamson has tended to use “maladaptation costs” (while retaining the term “transaction cost economics”).

When I teach transaction costs I typically assign Doug Allen’s excellent 2000 essay from the Encyclopedia of Law and Economics and Lee and Alexandra Benhams’ more recent survey from my Elgar Companion to Transaction Cost Economics (unfortunately gated). Doug, for example, usefully distinguishes between a “neoclassical approach,” in which transaction costs are the costs of exchanging well-defined property rights, and a “property-rights approach,” in which transaction costs are the costs of defining and enforcing property rights.

What other articles, chapters, and reviews would you suggest to help clarify the definition and best use of the “transaction costs”? Or should we avoid the term entirely in favor of narrower and more precise words and phrases?

Creativity and Age

| Peter Klein |

| Peter Klein |

A common myth is that successful technology companies are founded by people in their 20s (Scott Shane reports a median age of 39). Entrepreneurial creativity, in this particular sense, may peak at middle age.

We’ve previously noted interesting links between the literatures on artistic, scientific, and entrepreneurial creativity, organization, and success, with particular reference to recent work by David Galenson. A new survey paper by Benjamin Jones, E.J. Reedy, and Bruce Weinberg on age and scientific creativity is also relevant to this discussion. They discuss the widely accepted empirical finding that scientific creativity — measured by high-profile scientific contributions such as Nobel Prizes — tends to peak in middle age. They also review more recent research on variation in creativity life cycles across fields and over time. Jones, for example, has observed that the median age of Nobel laureates has increased over the 20th century, which he attributes to the rapid growth in the body of accumulated knowledge one must master before making a breakthrough scientific contribution (the “burden of knowledge” thesis). Could the same hold through for founders of technology companies?

The Soft Underbelly of Business Model Innovation

| Nicolai Foss |

Business models have become important tools in the top-manager’s toolbox. A business model is the articulation of the logic by which a business creates and delivers value to customers. It also outlines the system of revenues and costs that allows the business to earn a profit. It is both a map—i.e., a mental representation—and the real structure of the company’s internal and external activity systems.

However, in spite of more than a decade’s interest in business models and the innovation, their specific leadership and organization design challenges are only beginning to be understood. What is specific about these challenges is that top-management needs a map of the existing business model and the one it aspires to implement and execute, and a plan of how to get there. Moreover, business models can be very complex systems, with many interlocking elements, requiring coordination. Hence, business model innovations are truly major organizational change projects.

Writers on business models typically outline a number of elements of a company’s business model. These include the value proposition, segments, the value chain, and revenue model. But many writers and practitioners alike tend to stress only or a few of these.

Writers on business models typically outline a number of elements of a company’s business model. These include the value proposition, segments, the value chain, and revenue model. But many writers and practitioners alike tend to stress only or a few of these.

Indeed, very often a single element of the business does stand out. For example, the tipping point business model of Groupon, Moolala and similar seems to be all about the value proposition centered on providing discounts on meals, products and services with local merchants. (more…)

Focused Firms and Conglomerates: Let a Thousand Flowers Bloom

| Peter Klein |

A renewed interest in conglomerates has brought forth a HBR blog post from Herman Vantrappen and Daniel Deneffe, “Don’t Write Off the (Western) Focused Firm Yet.” As they rightly point out, the choice between a focus and diversity “depends on the context in which the business operates. Specifically, focused firms fare better in countries where society expects and gets public accountability of both firms and governments, while conglomerates succeed in nations with high public accountability deficits.” I would put it slightly differently: the choice between focused, single-business firms and diversified, multi-business enterprises depends on the relative performance of internal and external capital and labor markets. The institutional environment — the legal system, regulatory practices, accounting rules — plays a huge rule here, but social norms, technology, and the competitive environment also affect the efficient margin between between intra-firm and inter-firm resource allocation.

The point is that all forms of organization have costs and benefits. There is no uniquely “optimal” degree of diversification or hierarchy or vertical integration or any other aspect of firm structure; the choice depends on the circumstances. Instead of favoring one particular organizational form we should be promoting an environment in which entrepreneurs can experiment with different approaches, with competition determining the right choice in each context. Let a thousand flowers bloom!

Update: From Joe Mahoney I learn that not only was Chairman Mao’s actual exhortation “Let a hundred flowers blossom,” but also he may have meant it sarcastically: “It is sometimes suggested that the initiative was a deliberate attempt to flush out dissidents by encouraging them to show themselves as critical of the regime.” My usage was of course sincere. :)

In the Journals

| Peter Klein |

Some interesting review issues and special collections are hot off the virtual presses. The Journal of Management has just released its annual review issue with a number of valuable papers, including this one of particular interest to the O&M crowd:

The Many Futures of Contracts: Moving Beyond Structure and Safeguarding to Coordination and Adaptation

Donald J. Schepker, Won-Yong Oh, Aleksey Martynov, and Laura PoppoIn this article, we review the literature on interfirm contracting in an effort to synthesize existing research and direct future scholarship. While transaction cost economics (TCE) is the most prominent perspective informing the “optimal governance” and “safeguarding” function of contracts, our review indicates other perspectives are necessary to understand how contracts are structured: relational capabilities (i.e., building cooperation, creating trust), firm capabilities, relational contracts, and the real option value of a contract. Our review also indicates that contract research is moving away from a narrow focus on contract structure and its safeguarding function toward a broader focus that also highlights adaptation and coordination. We end by noting the following research gaps: consequences of contracting, specifically outcome assessment; strategic options, decision rights, and the evolution of dynamic capabilities; contextual constraints of relational capabilities; contextual constraints of contracting capabilities; complements, substitutes, and bundles; and contract structure and social process.

The always-interesting Strategic Organization has also released a package of previously published papers as a virtual special issue titled “Whither Strategy?” I have a soft spot for anything using the word “whither,” but this is a great collection by any name. Check out the ToC:

- Advancing strategy and organization research in concert: Towards an integrated model? | Durand, R. 2012. Volume 10, Issue 3. pp.297-303

- The end of strategy? | Farjoun, M. 2007. Volume 5, Issue 3. pp.197-210

- Strategic organization: A field in search of micro-foundations | Felin, T., & Foss, N.J. 2005. Volume 3, Issue 4. pp.441-455

- The disintegration of strategic management: it’s time to consolidate our gains | Hambrick, D.C. 2004. Volume 2, Issue 1. pp.91-98

- Stylized facts, empirical research and theory development in management | Helfat, C.E. 2007. Volume 5, Issue 2. pp.185-192

- So you call that research?: mending methodological biases in strategy and organization departments of top business schools | Heugens, P., & Mol, M.J. 2005. Volume 3, Issue 1. pp.117-128

- Process thinking in strategic organization | Langley, A. 2007. Volume 5, Issue 3. pp.271-282

- The field of strategic management within the evolving science of strategic organization | Mahoney, J.T., & McGahan, A.M. 2007. Volume 5, Issue 1. pp.79-99

- Walking the walk as well as talking the talk: replication and the normal science paradigm in strategic management research | Mezias, S.J., & Regnier, M.O. 2007. Volume 5, Issue 3. pp.283-296

- Paradigm prison, or in praise of atheoretic research | Miller, D. 2007. Volume 5, Issue 2. pp.177-184

- The Strategy Research Initiative: Recognizing and encouraging high-quality research in strategy | Oxley, J.E., Rivkin, J.W., & Ryall, M.D. 2010. Volume 8, Issue 4. pp.377-386

- The brain as substitute for strategic organization | Powell, T.C., & Puccinelli, N.M. 2012. Volume 10, Issue 3. pp.207-214

- The cultural side of value creation | Ravasi, D., Rindova, V., & Dalpiaz, E. 2012. Volume 10, Issue 3. pp.231-239

- A sociological perspective on strategic organization | Ruef, M. 2003. Volume 1, Issue 2. pp.241-251

- Strategy-as-practice meets neo-institutional theory | Suddaby, R., Seidl, D., & Le, J.K. 2013. Volume 11, Issue 3. pp.329-344

- How to connect strategy research with braoder issues that matter? | Vaara, E., & Durand, R. 2012. Volume 10, Issue 3. pp.248-255

- Big Strategy/Small Strategy | Whittington, R. 2012. Volume 10, Issue 3. pp.263-268

Recent Comments