Posts filed under ‘Management Theory’

Lazear on Leadership

| Peter Klein |

Ed Lazear tries his hand at the leadership literature in “Leadership: A Personnel Economics Approach.” The paper fits closely with his earlier work on entrepreneurship (here and here). Intuition:

The view presented [here] is that leaders are individuals who confront new situations often and choose the right direction in a high proportion of cases. Leaders also have the ability to identify situations where their skills will be needed and to do this frequently in a public setting. As a result of their success in choosing direction, and because the success is observable to others, leaders acquire followers who turn to the leaders for guidance in new and ambiguous situations. Individuals follow those who make correct decisions for a variety of reasons, the most direct of which is that they will boost their own probabilities of being correct by mimicking the decisions of the leaders. Thus, a leader is someone who has both vision and wisdom and who attracts a coterie of followers because of displayed superiority of decision making.

Because leaders are confronted with a wide variety of choices and because these choices span many fields, leaders tend to be generalists rather than specialists. Further, the broader the organization that an individual leads, the more general are the skills. . . .

An additional key ingredient is that leaders also possess the skills necessary to convince others that they have leadership ability. Consequently, communication skills are likely to be an important component in the leadership mix.

A formal model generates some testable propositions: “1. Ability and visibility, manifested in number of contacts per period, are complements. The most able seek to be the most visible in decision making settings. 2. The most able leaders are in the highest variance industries. 3. Leaders are generalists.” Survey data from Stanford MBAs are consistent with #2 and #3. Overall, a useful contribution to the small economics-of-leadership literature pioneered by Ben Hermalin.

Update: I neglected to mention this very important paper on leadership.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Business Ethics Symposium in Reason Papers

| Peter Klein |

From Reason Papers 31 (Fall 2009):

Articles: Business Ethics Symposium

- Rival Paradigms in Business Ethics —Nicholas Capaldi

- The Need for Realism in Business Ethics —Elaine Sternberg

- The Virtue of Prudence as the Moral Basis of Commerce —Tibor R. Machan

- Hume and Smith on the Moral Psychology of Market Relations, Practical Wisdom, and the Liberal Political Order —Jonathan Jacobs

- Ethics without Profits —Douglas Den Uyl

- Is a Market for Values a Value in Markets? —Alexei Marcoux

- The Sloppiness of Business Ethics —Marianne Jennings

- The Business Ethics of Incarceration: The Moral Implications of Treating Prisons Like Businesses —Daniel D’Amico & Joseph Butt

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

C. K. Prahalad (1941-2010)

| Peter Klein |

C. K. Prahalad died Friday at the age of 68. He’s best known for his “guru” work with Gary Hamel, but had turned his attention more recently to economic development , particularly the “bottom-of-the-pyramid” approach to poverty reduction. Here are thoughts and reminiscences from the WSJ, HBR, Ross Emmett, and the Ross School. HBR has already set up a Prahalad page. Here are previous O&M mentions. I last saw him at the 2009 SMS conference in Washington, D.C. where he spoke with Yves Doz on “The Future of Strategy.”

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

A Real Hostage Model

| Peter Klein |

Forget Williamson (1983). Check out Randall Morck and Fan Yang’s analysis of the 19th-century banks Shanxi, China. These banks featured a dual-class equity structure and, to mitigate agency problems created by entrenched insiders, not only gave insiders few voting rights, but also allowed outsiders to enslave insiders’ wives and children and hold their relatives as hostages. As Morck and Yang observe, with dry humor: “Modern civil libertarians might question some of these governance innovations, but others provide lessons to modern corporations, regulators, and lawmakers.”

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Lachmannian Entrepreneurship

| Dick Langlois |

The new issue of Organization Studies carries an article by John Mathews called “Lachmannian Insights into Strategic Entrepreneurship: Resources, Activities, and Routines in a Disequilibrium World.” Here’s the abstract.

Recent contributions to the organizational literature see the radical subjectivist and disequilibrium framework of Ludwig Lachmann as providing a suitable foundation for strategic entrepreneurial studies, in that his approach seeks independence from conventional equilibrium-based reasoning. In a Lachmannian spirit, this article suggests that strategizing can fruitfully be viewed as choices made by the entrepreneur in terms of the organization’s constituent resources, activities and routines together with their recombinations and complexifications. Cast in a general, disequilibrium setting, the strategic goals that guide the organizational entrepreneur’s strategizing can be formulated in terms of the construction and capture of resource complementarities, the pursuit of increasing returns through activities reconfiguration, and the generation of learning and dynamic capabilities through reconfiguration of routines. Once formulated in this way, the strategizing issues may be seen to make sense not just in the comparative static and imperfect equilibrium frameworks within which they have hitherto been posed, but in a more general dynamic and disequilibrium setting that corresponds to the real conditions in which firms are required to make entrepreneurial decisions. The simplified framework offers some hope for overcoming the balkanization of management scholarship that is so widely deplored.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Behavioral Corporate Strategy

| Peter Klein |

I’m not a huge fan of behavioral economics, though I obviously recognize its substantial and growing influence in economics, finance, entrepreneurship, and potentially, strategy. Many academics and commentators see the financial crisis as a vindication for behavioral economics research. Behavioral reasoning underlies the New Paternalism. I see the importance and implications of behavioral economics as overstated — the literature typically focuses on straw-man versions of “rationality” and largely ignores the effect of biases and heuristics on political decision-making — but it raises interesting issues in applied psychology.

My old friend Dan Lovallo has a nice piece (with Olivier Sibony) in the new McKinsey Quarterly making “The Case for Behavioral Strategy.” (It’s gated, but registration is free.) They make good arguments for applying behavioral insights into corporate decision making. The basic claim is that “we need new norms for activities such as managing meetings . . . , gathering data, discussing analogies, and stimulating debate that together can diminish the impact of cognitive biases on critical decisions. To support those new norms, we also need a simple language for recognizing and discussing biases, one that is grounded in the reality of corporate life, as opposed to the sometimes-arcane language of academia.” I agree, and urge you to check it out.

Add to: Facebook | Digg | Del.icio.us | Stumbleupon | Reddit | Blinklist | Twitter | Technorati

Posner on Institutions and Organizations, Round Two

| Peter Klein |

Remember the infamous Posner-Coase-Williamson exchange from JITE, 1993? Posner dismissed the New Institutional Economics as a derivative form of Posnerian law and economics, prompting unhappy replies from Coase and Williamson. Here’s Coase:

Posner [1993, 79] says that the first part of his paper describes “the conception of the field [the new institutional economics] held by Ronald Coase.” Reading this part of his paper recalled to my mind Horace Walpole’s opening remarks in his book on King Richard the Third: “So incompetent has the generality of historians been for the province that they have undertaken, that it is almost a question, whether, if the dead of past ages could revive, they would be able to reconnoitre the events of their own times, as transmitted to us by ignorance and misrepresentation” (Walpole [1768, 1]). I have only one foot through the door but should the final yank come before this piece is published, Horace Walpole’s words would apply exactly to Posner’s highly inaccurate account of my views.

Adds Williamson, wryly: “Richard Posner is a prolific writer and distinguished jurist. He is frequently asked to speak with wisdom and authority on many issues. Whether he hits the mark or misses varies with his depth of knowledge and understanding of those issues. . . . I content that Posner’s [1993] commentary mainly misses.”

Now Geoff Hodgson has produced a reboot: a long essay by Posner in the Journal of Institutional Economics titled “From the New Institutional Economics to Organization Economics: with Applications to Corporate Governance, Government Agencies, and Legal Institutions,” with replies from Jürgen Backhaus, Bruno Frey, Lin Ostrom, John Roberts, Tom Ulen, and several others (but not Coase or Williamson!). Posner focuses almost exclusively on the principal-agent problem, perhaps unaware that information, delegation, coordination, and adaptation are also important issues in organizational economics. His main conclusion seems to be that both private firms and public agencies are equally inefficient. Interesting reading, to be sure (and much better than Posner’s solipsistic essay on his conversion to Keynesianism, inexplicably published by the New Republic).

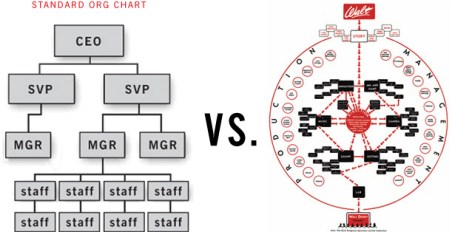

A New Organizational Chart

| Peter Klein |

Fodder for dozens of future PhD dissertations, no doubt! (Click to enlarge.)

Shareholder-Stakeholder Smackdown: Jensen, Freeman, Mintzberg, Khurana

| Peter Klein |

This looks like a fun event. Watch the Big Guys debate the future of the firm, management, and management education. It’s Fordham University’s W. Edwards Deming Memorial Conference, 11 May 2010 in New York City. Kudos to Mike Jensen for his willingness to walk into what will be, presumably, a line of fire. And remember, management theory is not to blame.

Williamson Tribute in California Management Review

| Peter Klein |

Six new essays on Oliver Williamson by Haas School colleagues appear in the new issue of the California Management Review. They’re behind a subscription firewall, but just $6 a pop. Check ’em out:

Institutions, Politics, and Non-Market Strategy

de Figueiredo, Jr., Rui J.P.

Holdup: Implications for Investment and Organization

Hermalin, Benjamin E.

Antitrust Economics

Shapiro, Carl

Regulation: A Transaction Cost Perspective

Spiller, Pablo T.

Williamson’s Contribution and Its Relevance to 21st Century Society

Tadelis, Steven

Williamson’s Impact on the Theory and Practice of Management

Teece, David J.

Thanks to Mike Cook for the tip.

The Capitalist Kibbutz

| Peter Klein|

That’s how the Financial Times headlines this fascinating story about the transformation of many Israeli kibbutzim into partially privatized, profit-seeking, professionally managed entities that act in capital, product, and factor markets just like private firms. There are some similarities with the end of the socialist experiment in Russia: “‘The kibbutz was never isolated from society,’ says Shlomo Getz, the director of the Institute for Research of the Kibbutz at Haifa University. ‘There was a change in values in Israel, and a change in the standard of living. Many kibbutzniks now wanted to have the same things as their friends outside the kibbutz.”

The bottom line, from economist and former kibbutznik Omer Moav: “People respond to incentives. We are happy to work hard for our own quality of life, we like our independence. It is all about human nature — and a socialist system like the kibbutz does not fit human nature.” (Via BK Marcus.)

Interview with a Randian CEO

| Peter Klein |

Today is Ayn Rand’s birthday, so in her honor we direct you to the December 2009 issue of Academy of Management Learning and Executive, which features an interview with BB&T Bank CEO John Allison, a follower of Rand. Access appears to be restricted to AoM members (manuscript version here, published version here). Sample:

After I went to work I began to read philosophy, in search for the answers to the big questions of life. I became interested in what I consider to be the great reason/reality based philosophers — Aristotle, Thomas Aquinas, John Locke, Thomas Jefferson and Ayn Rand.

That philosophical background combined with my own observations, which I call my inductions from life, together with my family upbringing, formed my philosophical framework as a young adult and executive. In 1993 or 1994 I read Objectivism: The Philosophy of Ayn Rand by Leonard Peikoff. This book really integrated everything for me. It enabled me to focus my thinking. By this time, I had been CEO of BB&T for a few years and we were in the midst of a merger of equals. It was very important that we have a clearly defined value system. Two large organizations with cultures that had some differences had to come together with a single value system. Peikoff’s book put everything together for me. We had some of the basics of a value system — honesty, integrity, traditional conservative business values, but we also held a number of contradictions. What Rand’s philosophy did for me was to provide a framework for how to integrate all the disparate pieces. I could see everything in a different way than I had seen before. Rand’s philosophy provided an ordering. It also clarified concepts. For example, people often mix up justice with mercy. From Rand I learned that justice requires that you reward those who contribute the most with the most, which implied that paternalism is unjust; failing to deal with non-performance is unjust. Also, rationality is the foundation for values, and rationality can not be compromised.

NB: BB&T has funded a number of professorships in the last few years.

Positive Spillovers from Bad Behavior

| Peter Klein |

When I introduce in class the concept of influence activities I emphasize that these, like other forms of discretionary behavior, can have benefits as well as costs. Think of self-assessments, such as a faculty member’s annual report to the department head or Dean. Certainly, faculty will find creative ways to overstate their accomplishments, minimize their failures, make themselves look better relative to their peers, and so on, and the time and energy spent doing this can be considered influence costs. At the same time, a savvy department head or Dean knows how to read between the lines, to separate signal from noise, and generally how to extract useful information from these reports, information he or she might not otherwise have. The challenge for organizational design, then, is not to eliminate influence activities altogether, but to limit them to the point where marginal benefit equals marginal cost.

This popped into my mind the other day when I read (courtesy of Stephan Kinsella) the confessions of a self-described “law school asshole.” University of Pennsylvania 3L Steve Mendelsohn (writing in 1990) tells his fellow students: “You know who we are. We’re the ones who always have our hands up in class volunteering to answer the professor’s questions, or ready to ask one of our own at seemingly any and every opportunity. Everytime you hear one of our names called, you groan and turn to the person next to you and slowly shake your head from side to side.” He even admits his name was in the center square of the Asshole Bingo cards his fellow students would bring to class.

As with influence activities, however, law-school assholery seems to have public benefits: keeping the discussion going and the atmosphere lively, eliciting from the professor information that other students would like to have but are afraid to ask for, and so on. I confess that, as an instructor, I’d rather have a few such assholes in class than a room full of polite, well-behaved dullards.

The serious question is whether this applies to organizations more generally. Are “civilized” workplaces necessarily better than rough-and-rowdy ones? It’s easy to come up with examples of organizations run by jerks that failed, but do we have systematic empirical evidence that nice-guy firms finish first? Do the marginal costs of costs of placing rude, self-centered people in management positions outweigh the marginal benefits?

Ennen and Richter on Complementarity

| Nicolai Foss |

The notion of complementarity unites a number of the key concerns of this blog: It has been central in Austrian capital theory since Menger, it is key both in (sociological) organization theory (e.g., here) and in organizational economics (e.g., here), and it is of considerable relevance to the explanation of (sustained) performance difference (e.g., here). (In organizational economics and strategic management, complementarity is usually given the specific interpretation of “Edgeworth complementarity“). Complementarity has also helped to link some of these areas (e.g., here and here).

In a paper, “The Whole is More Than the Sum of Its Parts, Or Is It? A Review of the Empirical Literature on Complementarities in Organizations,” in the most recent issue of the Journal of Management, Edgar Ennen and Ansgar Richter of the European Business perform what is probably the first stocktaking of the complementarity literature. It is very well done and in many ways an eye-opener. Of particular interest is their separation of the literature in those that take an “interaction approach,” focusing on specific interaction effects among specific (typically few) elements (e.g., of organization structure) and those that take a “systems approach” and consider the performance outcomes of entire sets of multiple elements. (My own work with Keld Laursen on complementarity falls in the latter category). Here is the abstract:

The concept of complementarity denotes the beneficial interplay of the elements of a system where the presence of one element increases the value of others. However, the conceptual work on complementarities to date has not progressed sufficiently to constitute a theory that would offer specific predictions regarding the nature of the elements that form complementary relationships or the conditions for their emergence. To advance our understanding of complementarities, the authors provide a synoptic review of the empirical studies on this concept in leading journals in management, economics, and related disciplines over the period 1988-2008. The authors find that whether a study provides evidence of complementarities in organizations is at least partially driven by its investigative approach. On the basis of the findings, the authors argue that complementarities are most likely to materialize among multiple, heterogeneous factors in complex systems. Therefore, the absence of complementary relationships between a limited set of individual factors may not negate the possibility of complementarities, but rather point to the need for including further systems-specific factors in the analysis. The authors conclude by providing directions for future theoretical and empirical research and outlining managerial implications of the work.

Designing Internal Organization for External Knowledge Sourcing

| Nicolai Foss |

The heading to this post is the title of an upcoming special issue of the European Management Review, edited by my colleague at the Center for Strategic Management and Globalization at CBS, Dr. Larissa Rabbiosi, in collaboration with Dr. Toke Reichstein (also at CBS) and Prof. Massimo Colombo of the Politecnico di Milano. Two previous workshops organized by Larissa and Toke have dealt with similar issues (here and here). The theme of the workshop may be seen as concerning the organizational dimensions of “absorptive capacity,” a somewhat elusive concept. It has the potential of integrating key aspects of organizational economics with key ideas of the capabilities view. Submit a paper!

Do Top Scholars Make the Best University Leaders?

| Peter Klein |

Yes, says Amanda Goodall here and here. Here’s a summary and here’s some commentary. Her argument is based on inside knowledge, the ability to set appropriate standards, signaling, and legitimacy. Signaling strikes me as the most plausible (non-academic administrators may not have knowledge or legitimacy but they can hire subordinates who do). I haven’t studied the work carefully, however. Kudos to Goodall for tackling an important subject.

Her Vox article singles out economist-administrators for special mention. They seem to be doing quite well, Larry Summers notwithstanding.

A New Hawthorne Study

| Peter Klein |

Tanjim Hossain and John List have done a Hawthorne-type study on a Chinese high-tech manufacturing company. The paper, “The Behavioralist Visits the Factory: Increasing Productivity Using Simple Framing Manipulations,” is unfortunately gated at NBER. I’m surprised it’s taken this long for someone to take advantage of the current craze for field experiments to do this kind of study. (I wonder if IRB approval is easier when the test subjects are in China?) Check out the abstract:

Recent discoveries in behavioral economics have led to important new insights concerning what can happen in markets. Such gains in knowledge have come primarily via laboratory experiments — a missing piece of the puzzle in many cases is parallel evidence drawn from naturally-occurring field counterparts. We provide a small movement in this direction by taking advantage of a unique opportunity to work with a Chinese high-tech manufacturing facility. Our study revolves around using insights gained from one of the most influential lines of behavioral research — framing manipulations — in an attempt to increase worker productivity in the facility. Using a natural field experiment, we report several insights. For example, conditional incentives framed as both “losses” and “gains” increase productivity for both individuals and teams. In addition, teams more acutely respond to bonuses posed as losses than as comparable bonuses posed as gains. The magnitude of the effect is roughly 1%: that is, total team productivity is enhanced by 1% purely due to the framing manipulation. Importantly, we find that neither the framing nor the incentive effect lose their importance over time; rather the effects are observed over the entire sample period. Moreover, we learn that worker reputation and conditionality of the bonus contract are substitutes for sustenance of incentive effects in the long-run production function.

See also List’s paper with Levitt on the original Hawthorne experiments.

Felin and Foss Best Paper Award

| Peter Klein |

Congratulations to Nicolai and Teppo Felin for winning this year’s SO!WHAT Award for Scholarly Contribution for their 2005 paper “Strategic Organization: A Field in Search of Micro-Foundations” (ungated version). These are given by the journal Strategic Organization for the best paper published five years earlier (i.e., after some seasoning, based on impact as well as substance and originality). Look here (about half-way down the page) for praise from Jay Barney and Bruce Kogut. Way to go, guys!

Here are some prior O&M posts on microfoundations.

Disney Organizational Chart, circa 1943

| Peter Klein |

This week’s passing of Roy Disney has brought forth some interesting discussion of the firm founded by his uncle Walt and father Roy. Check out this Disney organizational chart from 1943 (click to enlarge), courtesy of design site @issue. Unlike the typical corporate hierarchy, writes Delphine Hirasuna, Disney’s “is based on process, from the story idea through direction to the final release of the film. All of the staff positions are in the service of supporting this work flow.” (From Cliff Kuang via WeLoveDataVis.)

Words of Wisdom from Williamson’s Banquet Speech

| Peter Klein |

The transcript is here. My favorite bit, which can be read as a response to the econ-bashers:

Being hard-headed means that we aspire to tell it like it is — be it good news or bad. Although we take no joy in the downside, it is our duty candidly to confront all circumstances whatsoever. Our abiding concern is with improving the condition of mankind. Myopia, denial, and obfuscation are the enemy.

Only as we admit to and, of even greater importance, come to understand the problems that confront us — be they current or impending, obvious or obscure, real or imagined — by identifying and explicating the mechanisms that are responsible for these problems, can we expect to make informed decisions. Since, moreover, things that we do not understand at the outset sometimes have redeeming purposes, such efforts to get at the essence will often uncover real or latent benefits. Altogether, our capacity to work in the service of mankind increases as complex contract and economic and political organization become more susceptible to analysis.

Tuesday’s Prize lecture, in case you missed my earlier link, is here. I don’t see a video of the banquet speech on the Nobel site, but maybe that’s coming later. (Thank goodness they found time to post the seating chart!)

One tiny nit-pick: Williamson quotes Carlyle’s famous “dismal science” line, implicitly equating “dismal” with “mean-spirited,” but of course Carlyle’s barb had nothing to do with Malthus or scarcity or trade-offs, but with the classical economists’ opposition to slavery, which Carlyle, Dickens, Ruskin, and other literary critics of capitalism strongly supported (1, 2).

Recent Comments